Margaritaville Meets the Courthouse: What Jimmy Buffett’s Estate Dispute Teaches Florida Families About Trusts

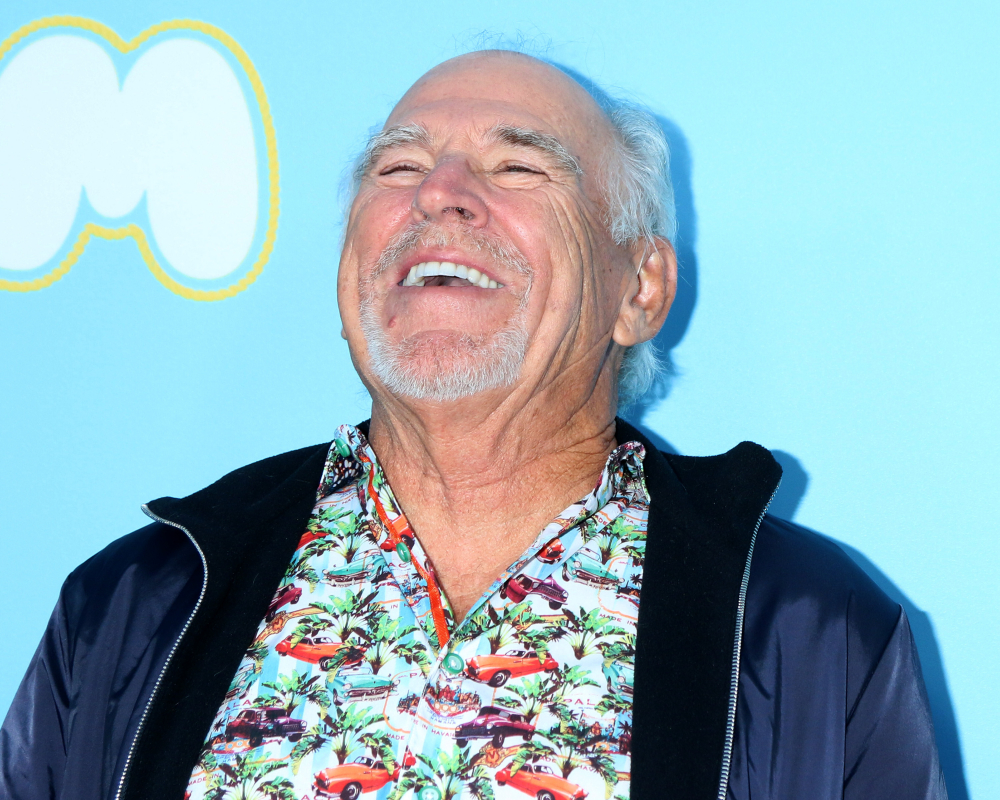

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog of beachy ballads. The "Margaritaville" singer also left behind a massive estate worth more than $275 million, including restaurants, resorts, real estate, and business interests.…