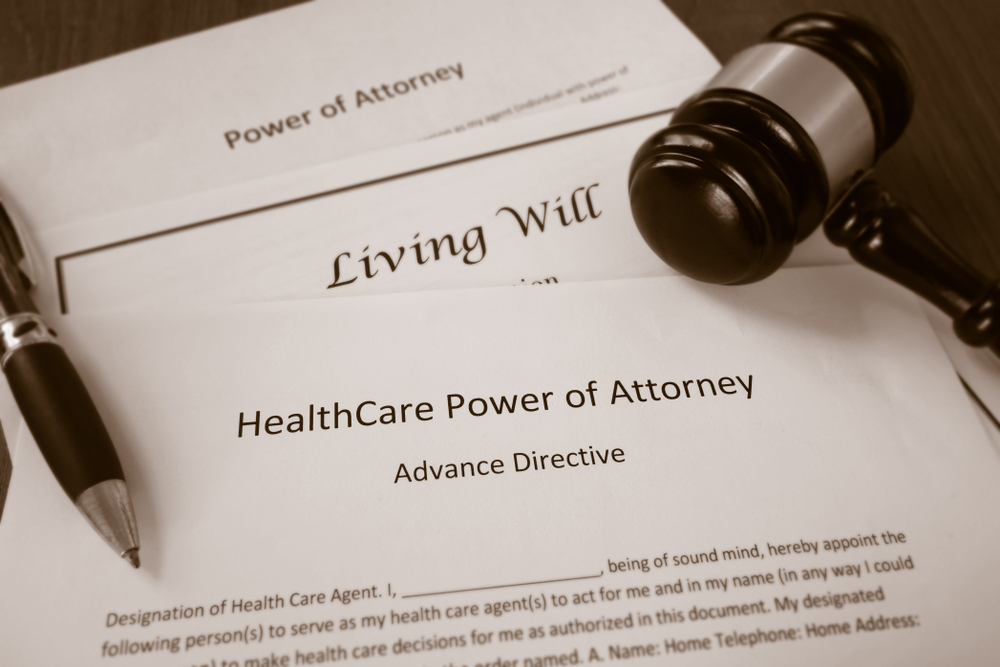

Beyond Medical Care: Personal Benefits of Advance Directives

Takeaways Advance directives, including health care powers of attorney and living wills, are crucial for outlining your medical wishes and appointing a surrogate decision-maker. Creating these documents involves personal reflection on quality of life, end-of-life preferences, and whom you trust…