The estate tax gets many headlines and was a focal point in recent negotiations over…

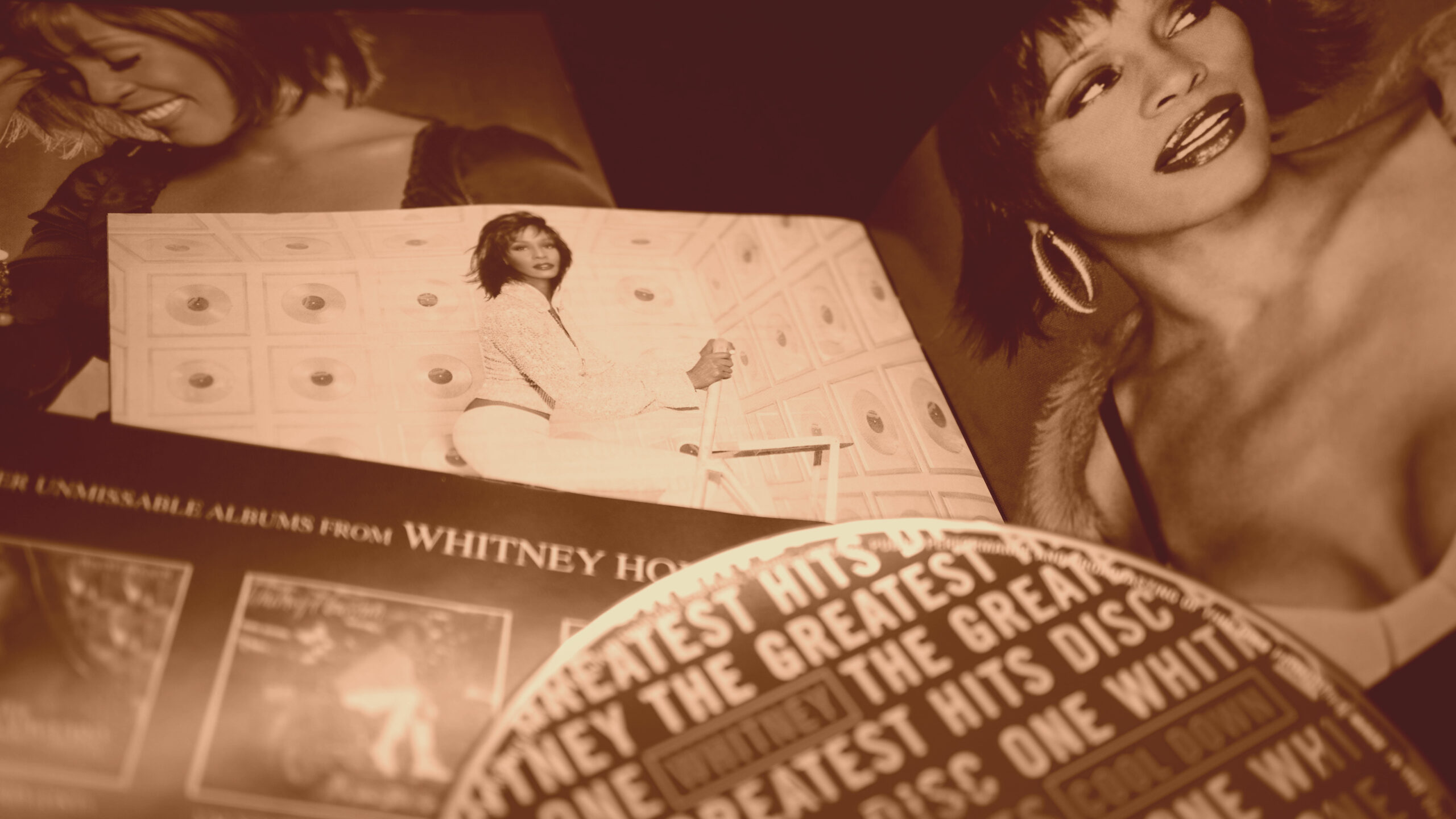

Lessons from Whitney Houston and Bobbi Kristina Brown: Why Proper Estate Planning Matters

Estate planning is a vital step to ensure your wishes are honored and your loved ones are cared for after your passing. Unfortunately, many people overlook the importance of updating their estate plans, leading to unintended consequences. A prime example of this is the case of Whitney Houston and her daughter, Bobbi Kristina Brown. In this blog, we will delve into their story to illustrate the importance of proper estate planning and how a more thorough approach could have altered the outcome.

The Whitney Houston and Bobbi Kristina Brown Case

Whitney Houston, an iconic singer and actress, executed her will in 1993. The will stipulated that her entire estate be left to her daughter, Bobbi Kristina Brown, in installments: one-tenth at age 21, one-sixth at age 25, and the remainder at age 30. Whitney Houston passed away in 2012, and Bobbi Kristina inherited a portion of the estate when she turned 21.

Tragically, Bobbi Kristina Brown died at the age of 22 in 2015, leaving the remaining assets to be distributed as per the outdated will. This situation resulted in a series of legal complications and financial difficulties that could have been avoided with an updated and comprehensive estate plan.

The Importance of Regularly Updating Your Estate Plan

Whitney Houston’s case highlights several critical lessons for anyone considering estate planning:

- Periodic Reviews and Updates

Life is dynamic, and so are your relationships and financial situations. Regularly reviewing and updating your estate plan ensures that it reflects your current circumstances and wishes. Major life events such as births, deaths, marriages, or divorces should trigger a review of your estate plan to accommodate new family members or changes in relationships.

- Consider the Maturity of Beneficiaries

One of the key issues in Whitney Houston’s estate plan was the large sum of money left to Bobbi Kristina at a young age. Managing a substantial inheritance can be challenging for young adults, potentially leading to financial mismanagement or undue stress. A well-structured estate plan can include trusts or staggered distributions to ensure beneficiaries receive support at appropriate stages of their lives.

- Comprehensive Planning

Estate planning is not just about writing a will. It involves a holistic approach, including creating trusts, designating powers of attorney, and establishing healthcare directives. These elements work together to ensure your estate is managed and distributed according to your wishes, even if circumstances change.

- Professional Guidance

Working with an experienced estate planning attorney can help you navigate complex legal and financial landscapes. An attorney can provide valuable insights and ensure that your estate plan complies with current laws and best practices.

How Proper Estate Planning Could Have Made a Difference

If Whitney Houston had periodically reviewed and updated her estate plan, several issues could have been avoided:

- Appropriate Timing of Inheritances: Adjusting the distribution schedule to provide financial support when Bobbi Kristina was more mature might have prevented potential financial mismanagement.

- Contingency Plans: Including contingency plans for unforeseen events, such as Bobbi Kristina’s untimely death, would have ensured a smoother transition of the remaining assets to other intended beneficiaries.

- Legal and Financial Clarity: A comprehensive estate plan, regularly reviewed and updated, would have minimized legal disputes and financial uncertainties, providing peace of mind for Houston’s family.

The story of Whitney Houston and Bobbi Kristina Brown underscores the critical importance of proper and regularly updated estate planning. For residents of Melbourne, Florida and Brevard County seeking the guidance of a skilled estate planning attorney can help protect your legacy and ensure your loved ones are taken care of according to your wishes.

Don’t leave your estate to chance. Contact a reputable estate planning attorney in Melbourne, Florida, today to start or update your estate plan. Proper planning today can prevent heartache and legal battles for your loved ones tomorrow.

For more information or to schedule a consultation, contact our experienced estate planning attorneys in Melbourne, Florida. We’re here to help you secure your legacy and provide peace of mind for your family.