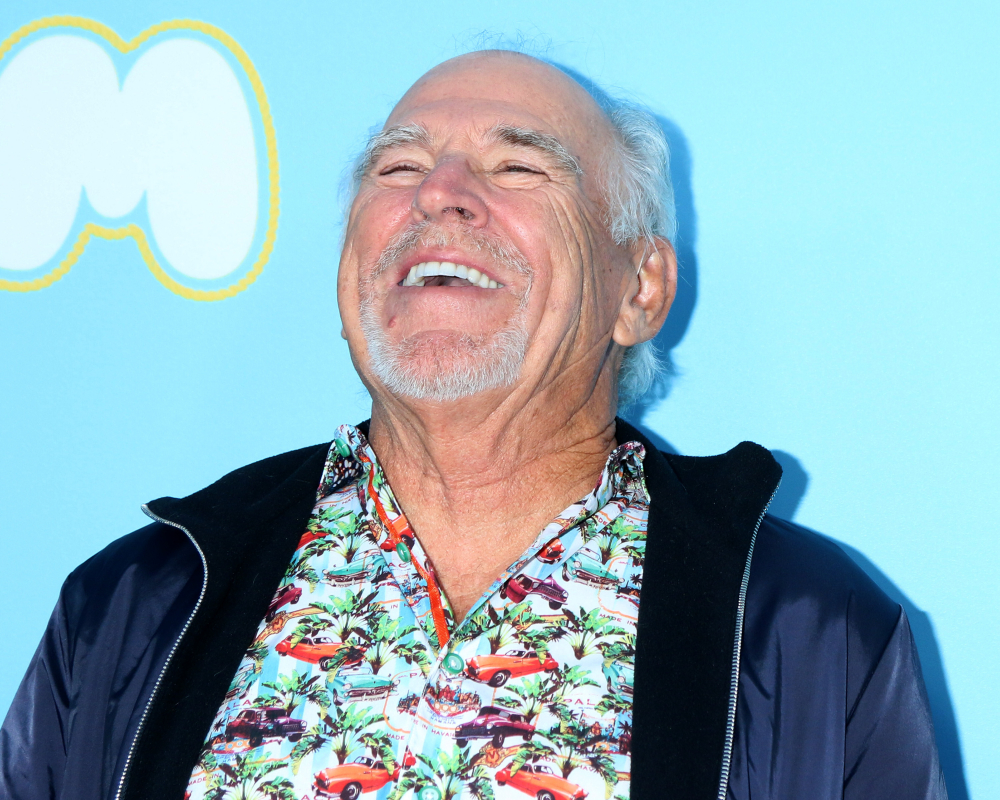

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Estate Planning for Blended Families

Estate planning is crucial for any family, but it becomes even more vital when it comes to blended families. Blended families, where one or both spouses have children from previous marriages, face unique challenges. Ensuring fair and equitable distribution of assets can be complex, but with careful planning, you can achieve a harmonious outcome that respects everyone’s wishes and needs. In this blog, we’ll explore key strategies and considerations for estate planning in blended families.

Estate Planning for Blended Families

Challenges that Impact Fair and Equitable Distribution

Blended families often have more intricate dynamics compared to traditional families. The presence of stepchildren, varying financial contributions, and different expectations can complicate estate planning. Without a clear plan, the distribution of assets might lead to disputes, strained relationships, and unintended outcomes. Here are some common challenges:

- Fair Distribution: Ensuring that both biological and stepchildren are treated fairly can be challenging. Each family member might have different expectations about what is “fair.”

- Complex Relationships: Relationships between stepchildren and stepparents can vary widely, influencing decisions about inheritance.

- Legal Considerations: State laws may affect how assets are distributed if there is no clear estate plan in place.

Key Strategies for Effective Estate Planning

1. Communicate Openly

Open and honest communication is the foundation of effective estate planning for blended families. Discuss your intentions with your spouse and children to manage expectations and reduce potential conflicts. Ensure everyone understands the reasons behind your decisions.

2. Update Your Will

A will is a fundamental document in estate planning. In blended families, it’s crucial to update your will to reflect your current wishes. Clearly specify how you want your assets to be distributed among your spouse, biological children, and stepchildren. Without an updated will, state laws may dictate the distribution, which might not align with your wishes.

3. Create a Trust

Trusts are powerful tools in estate planning, especially for blended families. They provide more control over the distribution of assets and can help avoid probate, which can be lengthy and public. Here are a few types of trusts to consider:

- Revocable Living Trust: This allows you to manage your assets during your lifetime and specify how they should be distributed after your death.

- Testamentary Trust: Created by a will, this trust comes into effect after death and can be used to provide for minor children or stepchildren.

- Qualified Terminable Interest Property (QTIP) Trust: This trust provides for a surviving spouse while preserving the ultimate distribution of assets for your children.

4. Beneficiary Designations

Review and update beneficiary designations on life insurance policies, retirement accounts, and other financial assets. These designations override what is stated in a will, so it’s essential they align with your overall estate plan. Ensure both biological children and stepchildren are considered in these designations as appropriate.

5. Prenuptial and Postnuptial Agreements

These agreements can clarify financial rights and responsibilities during marriage and in the event of death or divorce. While they might not be romantic, they provide legal protection and can prevent disputes later on.

6. Make Lifetime Gifts

Making lifetime gifts to your children and stepchildren can be a way to provide for them while you are still alive. This approach can also reduce the size of your taxable estate. However, be mindful of gift tax rules and potential implications for Medicaid eligibility.

Legal Considerations in Florida

Estate planning laws vary by state, and Florida has specific regulations that can impact your estate plan:

- Homestead Rights: Florida’s homestead laws provide protection for surviving spouses and minor children, which can complicate distribution if not properly planned for.

- Elective Share: Florida law allows a surviving spouse to claim an elective share of the estate, regardless of what is stated in the will. This share is typically 30% of the estate, which can affect the distribution to biological and stepchildren.

- Probate Process: Understanding the probate process in Florida is crucial. Proper use of trusts and updated beneficiary designations can help avoid probate and ensure a smoother distribution of assets.

Working with an Experienced Estate Planning Attorney

Given the complexities involved in estate planning for blended families, we recommend that you work with an experienced estate planning attorney. An attorney can help you navigate legal challenges, draft necessary documents, and ensure your plan reflects your wishes. They can also provide valuable advice on minimizing tax implications and protecting your estate from potential disputes.

Next steps

Estate planning for blended families requires careful consideration and proactive steps to ensure fair and equitable distribution of assets. By communicating openly, updating your will, considering trusts, and understanding legal considerations, you can create a comprehensive estate plan that respects the needs and wishes of your entire family. Consulting with an experienced estate planning attorney can provide the guidance and peace of mind needed to secure your family’s future.

Proper planning will preserve your legacy and ensure that your blended family is well cared for. It can also help you avoid potential conflicts and ensure harmony among all family members.