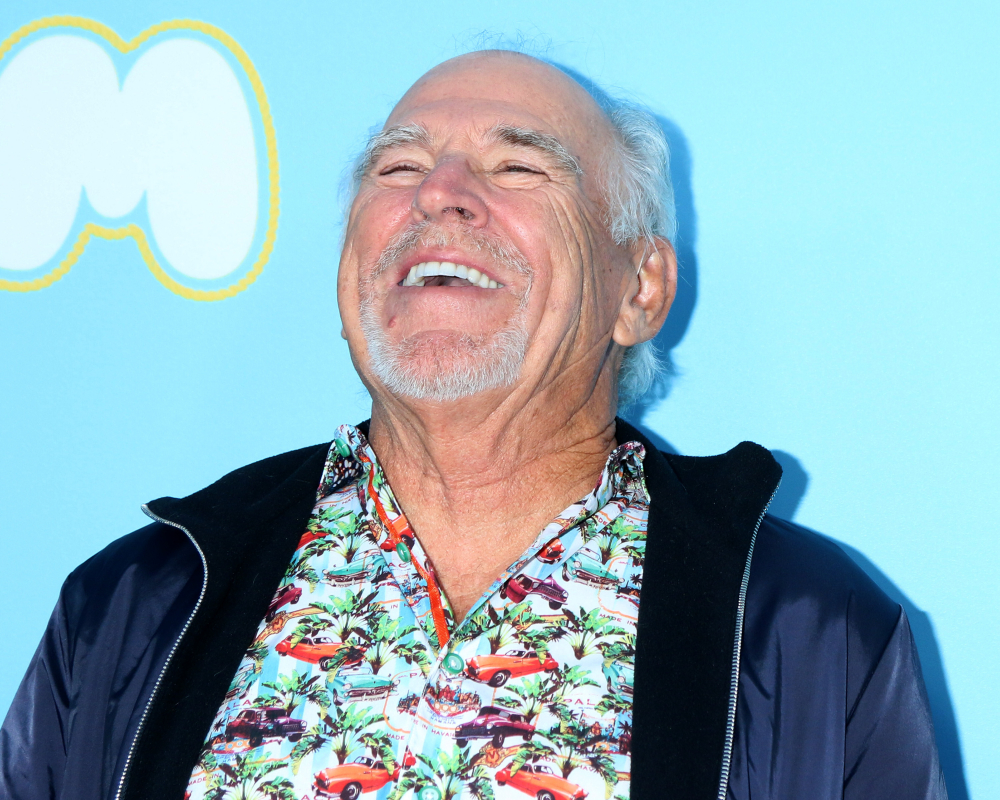

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Will a Living Trust Really Work Better Than a Will?

The potential for avoiding the process and costs of probate makes some people feel like living trusts are the answer to their estate planning problems. However, there are certain limitations and costs associated with trusts, which need to be considered before making a decision.

“Living trust” seminars have a single focus: that using this type of trust will save on the cost of probate costs, minimize taxes and make it easier on heirs. But a recent article in WealthAdvisor asks, “Do Living Trusts Save Money Or Just Heartache?” It’s important to understand that the seminar may not provide all of the details, and that may be part of the reason why not everyone has a living trust. Not everyone needs a living trust, although everyone needs a will.

Watch for seminars that are put on by people who aren’t lawyers. You should also remember that there’s no one right answer that works for everyone. Consult with an experienced estate planning attorney to see if a trust fits into your estate plan.

In reality, a living trust may be able to avoid probate costs in some situations. However, probate costs include the costs of internment, medical bills, costs relating to your death, costs of a service attending your death, any income or estate taxes due and legal fees for the settlement of your estate. Some seminars advertise that you can save on all these by using a living trust. However, the only thing that could be mitigated by having a living trust instead of a will, is the legal fee in settling your estate.

When you die, particularly when it’s the second death between spouses, liquid assets are placed into an account called an estate account. Your attorney’s office usually will set up an account for you, so your personal representatives can access these funds, when needed. But with a living trust, the individual you name as your trustee would need to do these same things, so they would eliminate some of the legal fees.

It’s very important to know in advance if your trustee is okay with all of these duties that are normally handled by an attorney. One way to find out is to get a sample document from the attorney of the living trust in its entirety. You should be prepared, because it is a long document. Ask your trustee to take some time to look through this document. If he or she has more questions than answers, it’s a red flag. If you can’t answer those questions, you’ll need to tell your trustee to speak to the attorney who drafted the document and see if he or she can explain all the duties of the trustee.

If your potential trustee still doesn’t understand his or her duties or feels uncomfortable handling these tasks, you may want to opt for another trustee or just go with a will. However, if your trustee is fairly competent at reading this document, understands their duties and doesn’t have any issues, then this could save some money for your estate.

Rather than getting sold on a particular document at a seminar, consult with an experienced estate planning attorney who will be able to review your individual situation to determine whether or not you will benefit from having a trust of any kind.

Reference: WealthAdvisor (September 18, 2017) “Do Living Trusts Save Money or Just Heartache?”