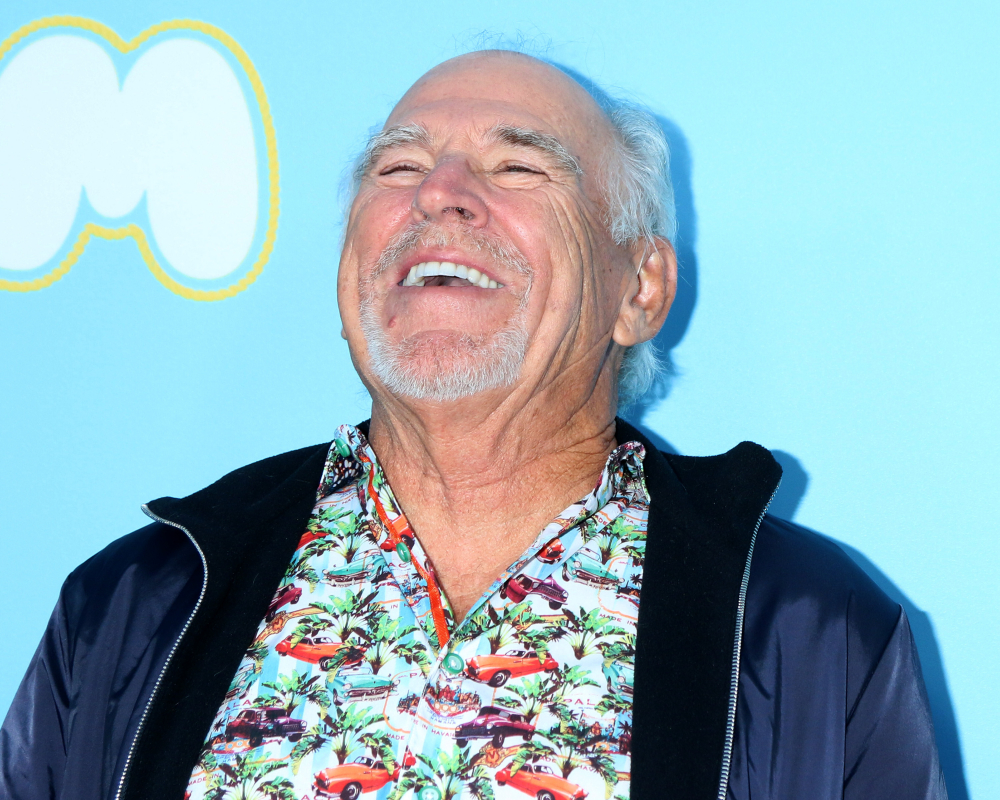

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

How Estate Planning and Business Exit Planning Work Together

Sometimes it’s easier to wrap your head around the idea of selling a business, when you see how the exit plan for a business must, by necessity, be a part of estate planning. This often helps owners more fully understand the process and move forward.

As described in Wilmington Insights’ article, “Which Comes First – Estate Planning Or Exit Planning?”, there are three key goals to a successful business plan:

- Financial security, where the business sale or transfer provides the income the owner and her family need after her exit;

- A successor selected by the owner, such as children, key employees, co-owners or a third-party; and

- Income tax minimization, giving the owner more cash in her pocket.

A successful estate plan also achieves three important personal goals:

- Financial security for the decedent’s heirs and family;

- Control by the decedent to choose who receives her estate assets; and

- Estate tax minimization to reduce the government’s share and give more to the decedent’s heirs.

If you look at exit planning and estate planning together, you can ask relevant questions in order to see the big picture:

- If you fail to exit the business as planned, how do you provide your family with the same income they’d have enjoyed if you had?

- Can you be sure your business retains its previously determined value?

- Does your estate plan reflect and implement your wishes, if you don’t survive after the exit?

- If you die before exiting the business, will your family still receive the full value of the business?

Business owners should determine if their estate plans address these issues.

Another goal is minimizing creditor risk for you and your heirs, which can be done with both exit and estate plans.

Keep this in mind when doing estate planning and exit planning: it is easier to avoid estate taxes than income taxes. Estate planning can also incorporate life insurance proceeds, which pay cash benefits on death, while business exit planning may require the use of your assets. Don’t neglect either one of these tasks. Failing to do one of them, can undermine planning done for the other. Contact our office and speak with an experienced estate planning attorney to make sure the two plans work well together.

Reference: Wilmington Insights (August 1, 2017) “Which Comes First – Estate Planning Or Exit Planning?”