What Is a Durable Power of Attorney? A durable power of attorney is an extremely…

Margaritaville Meets the Courthouse: What Jimmy Buffett’s Estate Dispute Teaches Florida Families About Trusts

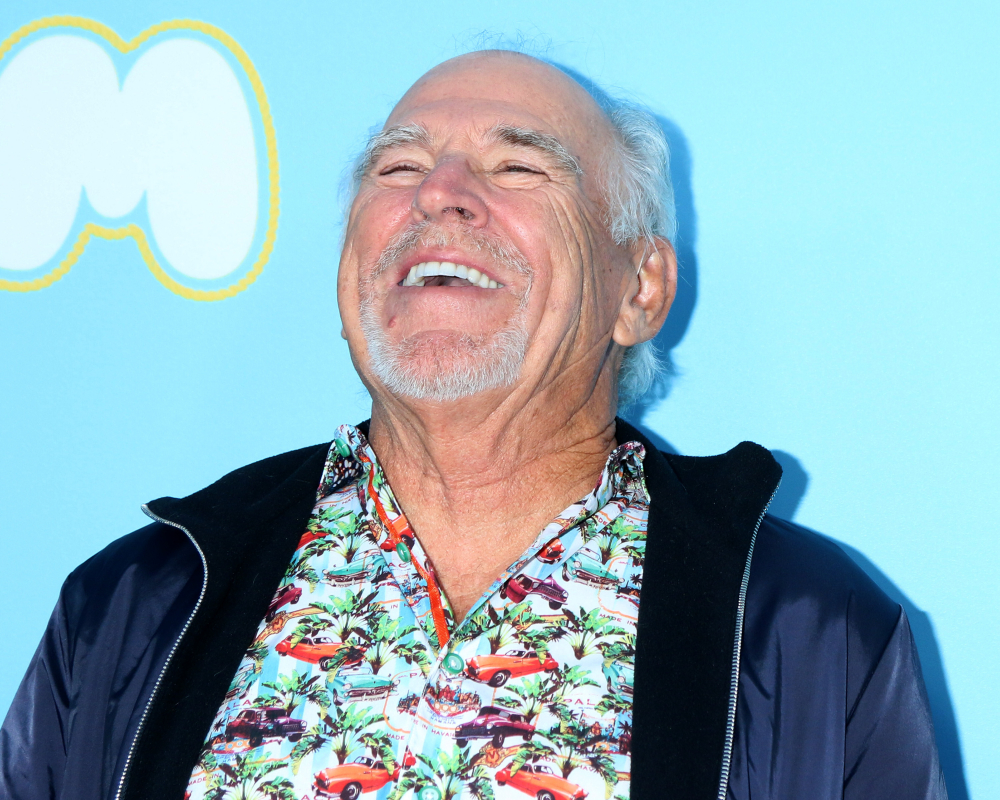

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog of beachy ballads. The “Margaritaville” singer also left behind a massive estate worth more than $275 million, including restaurants, resorts, real estate, and business interests. Most of it was placed in a marital trust for the benefit of his wife of 46 years, Jane Buffett, and their children.

But less than two years later, that trust is at the center of a growing legal battle—one that offers important estate planning lessons for Florida families.

What Went Wrong?

Buffett’s widow, Jane, has filed a lawsuit in California against the independent co-trustee, Richard Mozenter—Buffett’s longtime business manager. She claims he has:

- Withheld timely information about the trust’s financial health

- Paid himself more than $1.7 million in fees in one year

- Delivered poor investment returns—less than 1% annually

- Treated her with disrespect, creating a hostile environment

Mozenter claims he’s doing exactly what Jimmy Buffett intended—protecting the trust and limiting Jane’s control over it. He’s filed a competing action in Florida, where the couple owned a home, arguing that she should be removed instead.

Now, the case is unfolding in two states and serves as a cautionary tale—even for those of us with far less than $275 million to our names.

5 Florida Estate Planning Lessons from Jimmy Buffett’s Trust Dispute

- Co-Trustees Must Work Together—or Have a Way Out

In Florida, co-trustees must act together unless the trust says otherwise. If they can’t agree, it creates a deadlock—just like what we’re seeing in the Buffett estate.

Lesson:

If you’re naming more than one trustee (like a spouse and a professional advisor), include a tie-breaker provision or a way for one trustee to step down—or be removed—without court involvement.

- Trustees Owe Duties of Loyalty, Prudence, and Transparency

Under Florida Statutes § 736.0801–736.0813, trustees have strict duties to act in the beneficiaries’ best interest. That includes:

- Keeping accurate records

- Providing annual accountings

- Communicating material information

Failure to do so can be grounds for removal.

Lesson:

Make sure your trust requires periodic financial reporting and makes it easy for a beneficiary—like a surviving spouse—to request accountings or investment summaries.

- Trustee Compensation Should Be Clearly Defined

In Florida, trustee fees must be “reasonable,” but that can vary widely unless the trust defines the terms.

Mozenter reportedly paid himself millions while delivering poor returns. Jane Buffett claims she was unaware of the full fee structure or how funds were being invested.

Lesson:

In your trust, define what “reasonable compensation” means. You can:

- Set a flat annual fee

- Use a percentage of assets under management

- Require trustee fees be approved by a co-trustee or successor

Clarity reduces resentment—and litigation.

- Trust Modification and Removal Should Be Simple, Not a Court Battle

Florida law allows a court to remove a trustee for cause (F.S. § 736.0706), but that can take time, legal fees, and emotional energy.

Lesson:

Add a provision that lets beneficiaries—or a majority of them—remove a trustee without going to court. This gives flexibility if someone becomes uncooperative or unreasonable.

- Estate Planning Should Involve Family Conversations—Not Just Documents

No one wants their spouse fighting their accountant in court. But that’s exactly what’s happening now.

Many estate disputes are not about greed—they’re about confusion, poor communication, or clashing expectations.

Lesson:

Use your lifetime to talk openly with your loved ones about your wishes and who will be in charge. It’s especially important when leaving a spouse dependent on a trust for income. Meet with your attorney together if possible.

What Florida Families Can Do Now

You don’t need a tropical empire to learn from this case. If you live in Florida and have a blended family, own a business, or simply want to avoid family drama, here are three smart next steps:

- Create or update your revocable living trust

It avoids probate, allows for disability planning, and gives you control over what happens to your wealth.

- Choose your trustees carefully

Pick people who are financially responsible—and who will treat your spouse and children with dignity and fairness.

- Work with a Florida-based estate planning attorney

Every state has different rules. In Florida, the nuances of trust law, homestead rights, and spousal inheritance rules make local knowledge essential.

Final Thought

Jimmy Buffett’s music may be about escaping worries—but his estate plan reminds us that planning well is the real key to peace of mind. With the right documents, smart choices, and honest communication, your family can avoid turning paradise into probate.

Need help creating or reviewing a Florida trust?

We’re here to help you protect what matters most—with clarity, compassion, and real Florida expertise. Contact us today to create a comprehensive estate plan and protect your legacy.