What Is a Durable Power of Attorney? A durable power of attorney is an extremely…

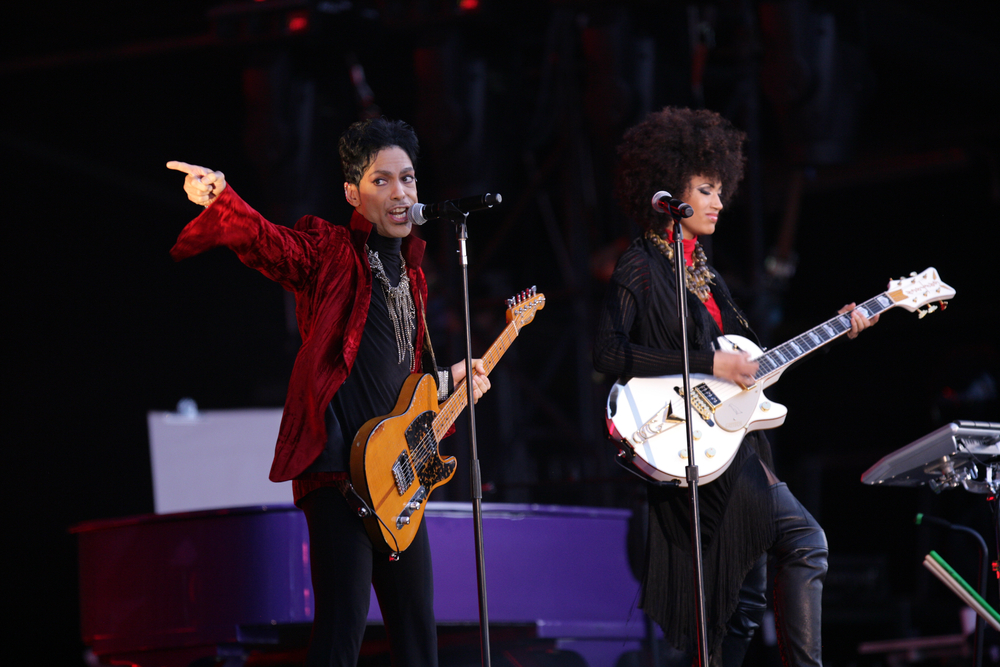

The High Costs of Probate: Lessons from Prince’s Estate and How Proper Planning Could Have Made a Difference

Probate can be a lengthy and expensive process, affecting not only the wealthy but also individuals of modest means. The case of Prince, the iconic musician who died without a will in 2016, serves as a poignant example of how the lack of proper estate planning can lead to protracted legal battles and significant financial burdens for relatives. This blog will explore the costs and complexities of probate, using Prince’s situation to highlight the importance of comprehensive estate planning.

Understanding Probate

Probate is the legal process by which a deceased person’s estate is settled, involving the validation of the will, inventorying of assets, paying off debts and taxes, and distributing the remaining assets to beneficiaries. When someone dies without a will (intestate), the probate court must determine the rightful heirs and oversee the distribution of the estate according to state law.

Costs and Time Involved

- Court Fees and Legal Costs: Probate involves numerous court filings and legal procedures, each incurring fees. Attorney costs can also accumulate, especially if the estate is complex or contested.

- Appraisal and Administrative Fees: Estates often require professional appraisals of property and assets, adding to the costs. Executors or administrators may also charge fees for their services.

- Extended Timeframes: Probate can take months or even years to complete, delaying the distribution of assets to heirs. This prolonged process can create financial hardship for beneficiaries waiting for their inheritance.

The Prince Estate Case

Prince Rogers Nelson, the legendary musician, died in 2016 without a will. His estate, estimated to be worth between $200 million and $300 million, became the center of a protracted legal battle among potential heirs, attorneys, and the court system.

Legal Battles and Costs

- Determining Heirs: The court had to identify and validate Prince’s heirs, which included his sister and five half-siblings. Numerous other individuals came forward claiming to be relatives, further complicating the process.

- Protracted Litigation: The legal battles over Prince’s estate dragged on for over six years, with various disputes over asset valuation, tax liabilities, and rightful ownership.

- Significant Expenses: The estate incurred millions of dollars in legal fees, administrative costs, and taxes, significantly reducing the amount available for distribution to the heirs.

How Proper Estate Planning Could Have Helped

- Creation of a Will and Trusts

If Prince had created a will, his wishes regarding the distribution of his assets would have been clear, reducing the need for the court to determine heirs. Establishing trusts could have provided a private and efficient means of managing and distributing his assets, bypassing probate altogether.

- Reduced Legal Fees and Court Costs

A well-structured estate plan could have minimized the legal fees and court costs associated with the probate process. By clearly outlining his intentions and appointing a trusted executor or trustee, Prince could have ensured a smoother and less costly transition.

- Faster Distribution of Assets

Proper estate planning would have expedited the distribution of assets to Prince’s beneficiaries. Trusts and other estate planning tools can allow for the immediate transfer of assets upon death, avoiding the lengthy probate process.

- Tax Planning

Effective estate planning includes strategies to minimize estate taxes. Prince’s estate faced significant tax liabilities, which could have been mitigated with proper planning, preserving more wealth for his heirs.

The case of Prince’s estate underscores the critical importance of comprehensive estate planning. Even for individuals of modest means, the probate process can be lengthy, expensive, and emotionally draining for loved ones. By creating a will, establishing trusts, and engaging in regular estate planning, you can protect your assets, reduce legal costs, and ensure a smoother transition for your heirs.

For residents of Brevard County Florida, consulting with an experienced estate planning attorney can provide the guidance and tools needed to avoid the pitfalls of probate. Don’t leave your estate to chance—start planning today to secure your legacy and provide peace of mind for your family.

For more information or to schedule a consultation, make an appointment to see one of our experienced estate planning attorneys in Brevard County FL. We’re here to help you secure your legacy and provide peace of mind for your family.