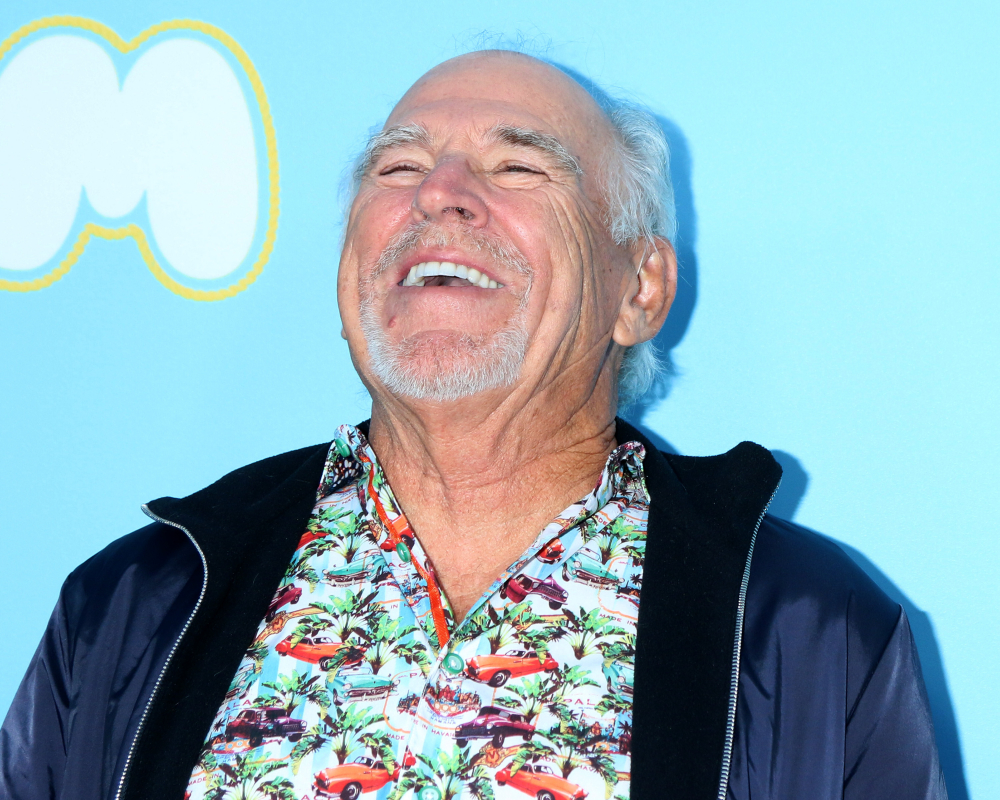

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Your Marital Status Affects Social Security Benefits

Marriage, divorce, or losing a spouse are all emotional experiences, but they are also financial ones. One thing to think about is how marital status changes your social security benefits. Understanding your options in different situations removes the burden of decision-making when you are focused on other matters.

There are four types of Social Security programs:

- Retirement

- Disability

- Supplemental Income (SSI)

- Survivor

Retirement social security is the most common type, and it is discussed most in this article. The amount you receive is based on the earnings of the documented work you do in the United States. Almost 94% of Americans are eligible for retirement Social Security.

The other six percent often lack enough eligible work history in the United States. Many government workers pay into a pension fund instead of Social Security insurance. Once they become vested, they can earn a pension when they retire. Individuals who did not work, worked in different countries, or got paid in cash “under the table” often have not paid into Social Security insurance and would not be eligible for retirement benefits. You can check your eligibility at ssa.gov/myaccount.

Getting Married

If you are getting married for the first time after you are already receiving social security retirement benefits, your payments will not be affected. Each of you will receive benefits based on your separate work history.

However, if you are remarrying while receiving spousal benefits (or eligible to receive them), your benefits (or eligibility) will likely change. There are many special circumstances, and conferring with an estate attorney or an elder law attorney, can help you make an informed decision.

Imagining Four Different Scenarios

- Fred and Joan meet, fall in love and get married at 62. Neither has ever been married, and they retire at 66. When they retire, they receive their full retirement benefits based on their separate earning histories. They then wonder if they would maximize their benefits by claiming a spousal benefit. After discussing it with their estate attorney, they decide it is better to keep social security payments separate.

- John and Susan got married young and stayed married. Susan earned significantly more than John. When they retired, they met with an elder law attorney to help them maximize spousal benefits. By coordinating their retirement age and strategy, they have a better income than they would by claiming independently.

- Stella and Jerome enjoyed a long, happy marriage until Jerome passed away suddenly in his fifties. Stella did not have enough eligible work contributions. She is too young to receive survivor benefits. At sixty, she is thinking about getting remarried but wondering how that will affect her survivor benefits. She is smart to consider this because she could lose claim to them, yet it might still be the right choice for her financially and emotionally. She decides to speak with an estate planning attorney to help her make the right decision.

- Pat and Whitney married young and stayed married for 15 years before divorcing. During their marriage, Pat worked while Whitney stayed home raising their children. They are nearing retirement age, and Whitney is eligible for spousal benefits based on Pat’s earnings. However, Whitney is considering getting remarried. If he remarries, he will lose any spousal claims from Pat. However, he may qualify for spousal benefits from his new spouse after one year of marriage. He decides to consult with a knowledgeable advisor before deciding to get married.

Getting Divorced

Like getting married, divorce does not affect your retirement social security earnings. It could, however, affect your spousal or survivor benefits. If an ex-spouse claims your benefits, it does not affect how much you or a new spouse receives. Let’s again imagine some scenarios.

- Let’s go back to Pat and Whitney. Whitney decides to marry again but soon realizes it was a mistake. They divorce a few months later. Whitney would still be eligible for spousal benefits from Pat when he reaches 62.

- Frank and Louise had been married for nine years when they started thinking about divorce. They know that spousal benefits would greatly help Louise, and she would not be eligible for them unless they stay married for ten years or more. They decide to stay married one more year.

- Brenda and Ferdinand both have a long eligible work history. After six years, they decide to divorce. Their Social Security benefits are unaffected by their marriage or subsequent divorce.

Becoming Widowed

Married couples must assume that one will become widowed at some point. It’s helpful to know when to apply for Social Security Survivor benefits. You can apply for them at age 60 unless special circumstances apply. However, AARP says delaying when you start receiving benefits may be better. Be sure to consider contacting an estate planning lawyer before filing for survivor benefits so they can review the specifics of your situation.

Love and Money

People often talk about marriage and divorce regarding love and living arrangements. Those are important considerations but remember that finances play a part in your security, especially in your later years. If you are considering changing your marital status, it might be worth your time to let us help you weigh your options. If you need assistance in any area contact us at (321) 729-0087.