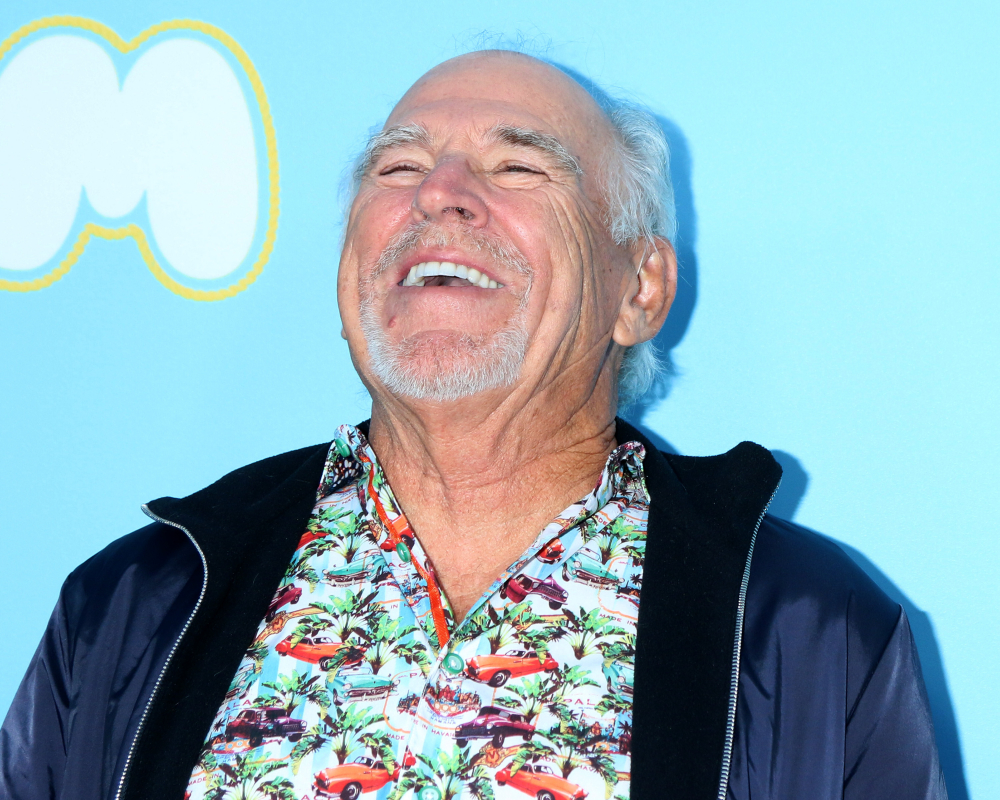

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

How Do You Pick the Right Person to be a Trustee?

One of the reasons people delay creating an estate plan and trusts, is that they don’t know who to name as a trustee. That’s not a good reason to put off something this important.

Your trustee may be in charge of a big or small estate, the care of a special needs individual or the family millions. Whatever they are responsible for, they have an important job. Clients often reach an impasse, when it comes to completing their estate planning because they are just not sure who the trustee should be. Sometimes a friend is a better choice than a family member. Other times, someone who is not a family member is a better selection.

Forbes’s recent article, “How To Choose A Trustee,” helps you identify what you should look for in a trustee.

If you go with a family member or friend, she should be financially savvy and good with money. You want someone who is knows something about investing, and preferably someone who has assets of their own that they are investing with an investment advisor.

A good thing about selecting a friend or family member as trustee is that they’re going to be most familiar with you and your family. They will also understand your family’s dynamics. Family members also usually don’t charge a trustee fee (although they are entitled to do so).

However, your family may be better off with a professional trustee or trust company that has expertise with trust administration. This may eliminate some potentially hard feelings in the family. Another negative is that your family member may be too close to the family and may get caught up in the drama. They may also have a power trip and like having total control of your beneficiary’s finances.

The advantage of an attorney serving as a trustee, is that they have familiarity with your family, if you’ve worked together for some time. There will, however, be a charge for their time spent serving as trustee.

Trust companies will have more structure and oversight to the trust administration, including a trust department that oversees the administration. This will be more expensive, but it may be money well spent. A trust company can make the tough decisions and tell beneficiaries “no” when needed. It’s common to use a trust company when the beneficiaries don’t get along, when there is a problem beneficiary or when it’s a large sum of money. A drawback is that a trust company may be difficult to remove or become inflexible. They also may be stingy about distributions if it will reduce the assets under management that they’re investing. You can solve this by giving a neutral third party, like a trusted family member, the ability to remove and replace the trustee.

Your estate planning attorney has helped many others make this decision, and they will be able to help you evaluate candidates to make the choice that is right for you and for your family.

Reference: Forbes (May 31, 2019) “How To Choose A Trustee”