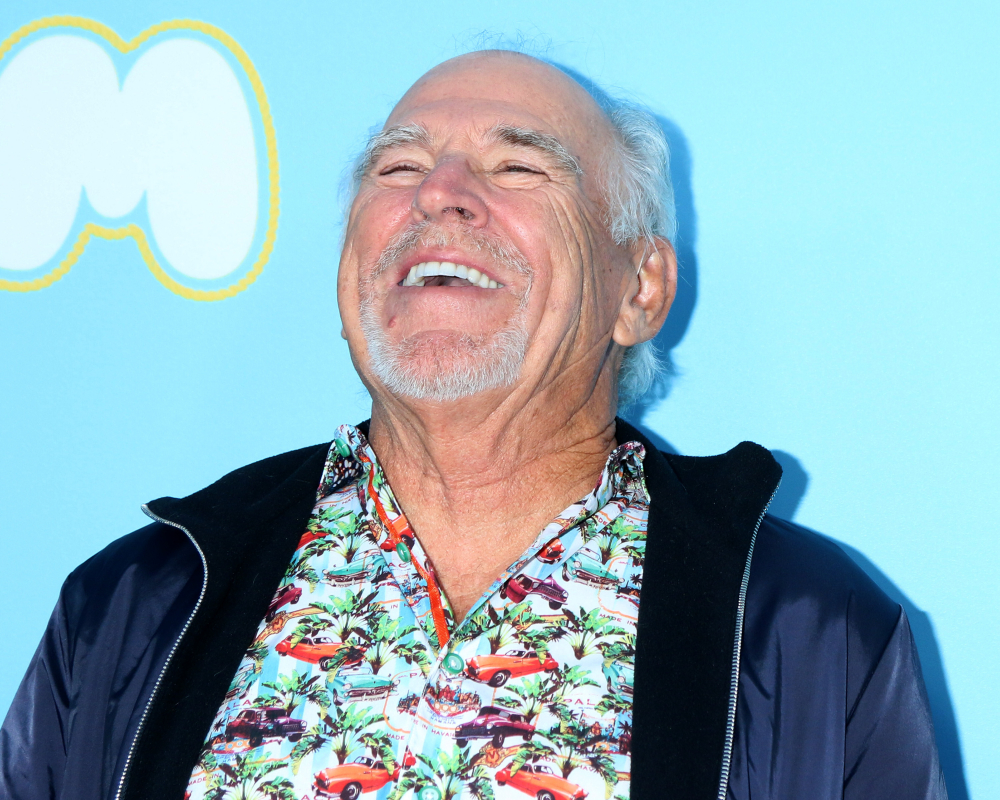

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

When is an Irrevocable Trust Revocable?

There was a time when irrevocable trusts were truly irrevocable. However, some states now offer ways to make changes—as long as you follow the rules carefully. Warning: penalties for mistakes can be significant, so work with an estate planning attorney to do this right.

Despite the name, an irrevocable trust actually does have some flexibility, and changes can be made to a grantor’s wishes, if the trust is no longer suitable. A recent article from Barron’s titled “Are Irrevocable Trusts True to Their Name?” explains it all.

It should be noted that irrevocable trusts must follow strict rules, and rules vary between states. One of the main reasons for an irrevocable trust is to remove assets from an estate for estate tax purposes. If the rules aren’t followed carefully, a trust can be rendered unlawful. If that happens, the assets may be returned to the grantor’s estate and estate taxes may apply.

If you want to be certain that beneficiaries have some discretion in the future if circumstances change, grantors should build flexibility into the trust when it’s established. This can be accomplished by giving a power of appointment to beneficiaries. However, if the beneficiaries are looking to change the terms or the structure of an existing trust, the trust must be modified according to state law.

Most states allow trusts to be decanted. When you decant a trust, you pour its terms into a new trust, and leave out the parts that are no longer wanted. Just like decanting a bottle of wine, it’s like the sediment left in the wine bottle.

In a state that doesn’t permit decanting, a trustee can ask a judge to allow it. You should be careful with decanting, because you don’t want to do anything that would adversely affect the original tax attributes of the trust.

The power of appointment in a trust or the ability to decant can’t be given to the person who set up the trust. Thus, grantors can’t have a “re-do” or rescind the terms. It’s only trustees and the beneficiaries that can do that.

If you and your attorney create a trust with a lot of flexibility for the trustee, you may want to appoint an institutional trustee from a bank, trust or other financial services company. They can be either the sole trustee or serve as co-trustees with a personal, non-institutional trustee, like a family member. This can help to eliminate future conflicts.

Higher estate tax exclusion has increased the interest in irrevocable trusts. Many high-net worth people want to create a new trust or add more assets to an existing irrevocable trust to take advantage of the higher exclusion.

Reference: Barron’s (June 18, 2019) “Are Irrevocable Trusts True to Their Name?”