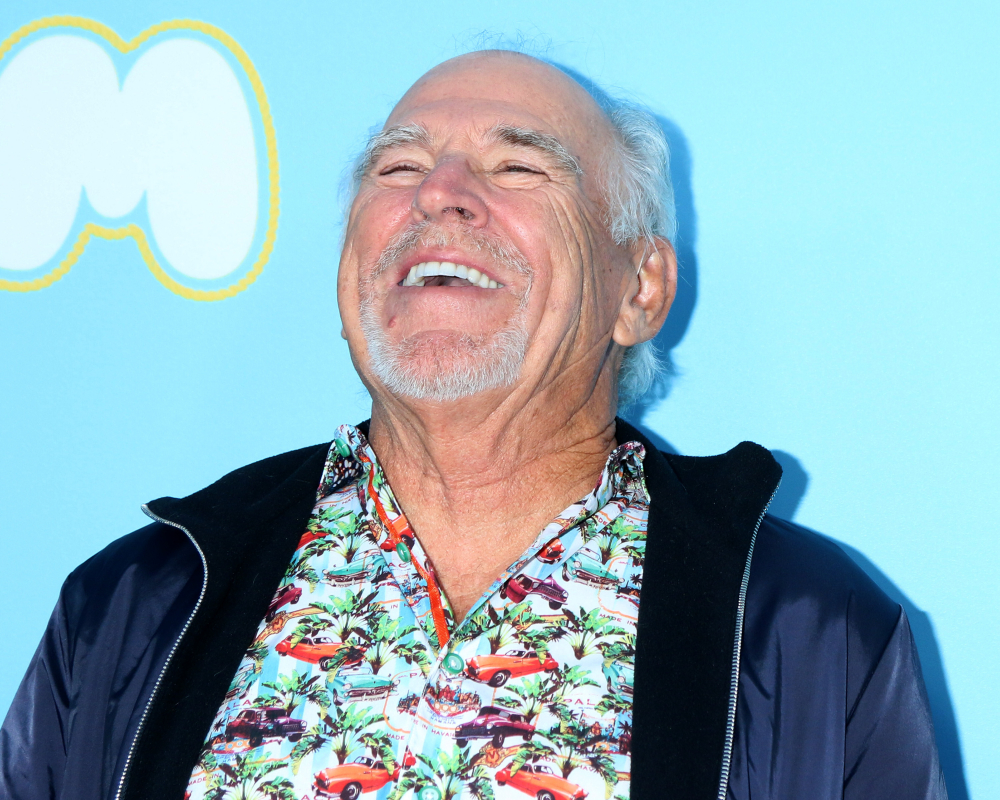

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Have You Overlooked Company Benefit Plan Designations in Your Estate Plan?

See if you remember this: you started at your new job with a meeting with HR. You signed a lot of paperwork, agreeing with corporate policies and acknowledging receipt of the company handbook. You also named a person or persons to be your beneficiary on a few different employee benefit offerings: life insurance, a stock purchase plan and a 401(k) plan.

Now, fast-forward to today. Do you remember who you named as your beneficiaries? If you remember, are they still the same people who you want to receive these benefits? This is a common problem, says Forbes in the recent article, “Company Benefit Plan Designations Can Lead To A Huge Estate Planning Blunder.”

These company benefits that have likely grown over the years, are still going to the people who you named so long ago, regardless of what is contained in your will.

Assets that have a form of joint or survivor ownership or have named beneficiaries, pass on to heirs by law and they aren’t part of your probated estate. This usually applies to homes, bank and investment accounts, life insurance, retirement plans, and corporate asset accumulation plans. In other words, these are all the plans and accounts where you originally named beneficiaries, but probably haven’t changed those beneficiaries since your first day of work.

When you started your job, you probably named your spouse as your primary beneficiary. If you named a contingency beneficiary, it was probably your children. The secondary designation is probably not something to which you gave a lot of thought. However, if your spouse predeceases you, and if your plans designated your children as contingent beneficiaries, they would inherit all your company benefit plans at once, or upon reaching majority of age 18 or 21.

You may prefer that your children inherit this sizable asset in a more controlled manner. If that is the case, you’ll want to review these designations in conjunction and also consider how they align with your estate plan. Speak with your estate planning attorney about your work benefits and how they can be passed to your heirs in the way you wish, whether that is all at once or in a gradual progression. Don’t forget to update your documents at work.

Reference: Forbes (April 22, 2019) “Company Benefit Plan Designations Can Lead To A Huge Estate Planning Blunder”