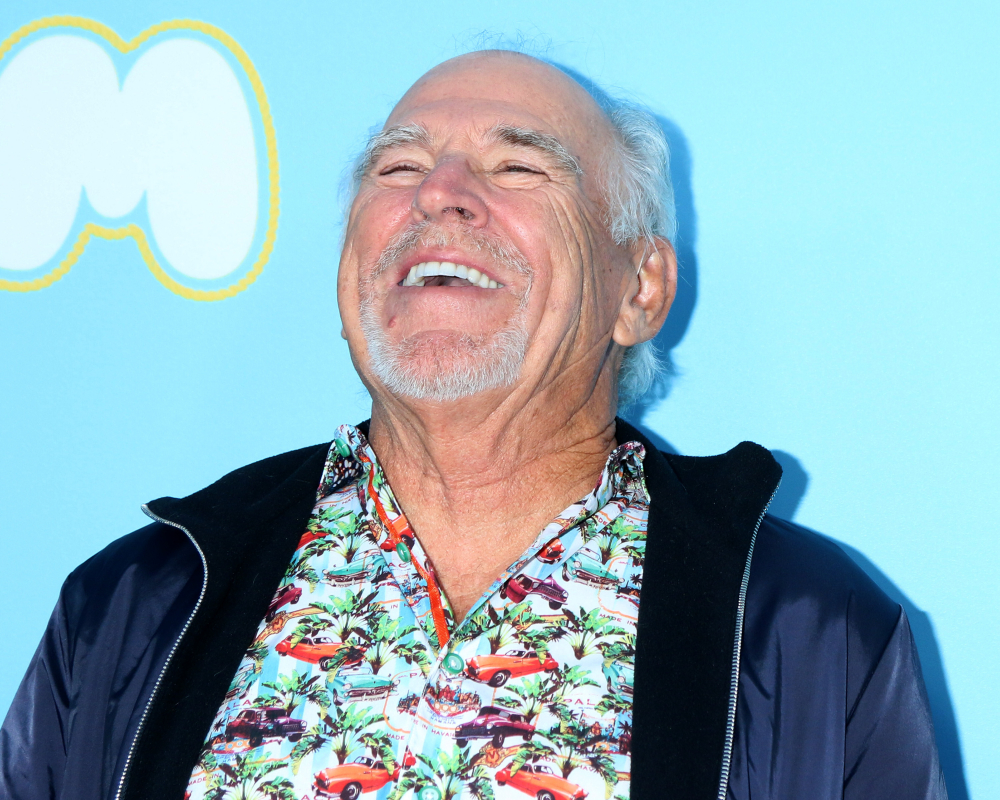

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Middle-Class People Need Estate Planning Just As Much, If Not More Than The Wealthy

With less room for error, it makes sense that someone with a modest home and retirement savings needs estate planning to protect their families.

When a billionaire loses half of his wealth in a divorce, they’re still wealthy. But when a middle-class person hasn’t planned for estate distribution or long-term health care, there’s more of a chance their retirement could be at risk. That’s part of what Forbes explains in “Why Estate Planners Aren’t Just for the Ultra-Rich,”

Although estate plans may be more complicated for larger estates, just about everyone can benefit from having one. Let’s examine the main reasons why:

Avoiding probate. This is a big reason why the importance of estate planning is for everyone. You don’t have to be part of the 1% to want to avoid putting your family through the stress and expense of probate. Creating a trust and strategically placing assets within its control, eliminates many headaches.

Maintaining control from the grave. Even after death, you can still impact how your assets are distributed, as well as to whom and when.

Protecting your legacy. When you consider leaving a legacy for the next generation, it may have lofty pursuits. However, those aren’t necessarily reasonable goals for everyone. Leaving a legacy can also mean making certain that heirs properly respect all the effort and sacrifice that it took to save and create a retirement fund—whatever its size.

Creating a business succession plan. Among the countless small businesses in the U.S., most will continue to remain viable after the legacy owner dies. A business owner can plan for this within an estate plan which details exactly what they want to happen, if they die unexpectedly. That could include outlining specific roles and responsibilities for surviving heirs or putting into place a buy-sell agreement with a business partner and directing the distribution the proceeds of the sale.

All estate plans need to be reviewed on a regular basis. That may be when tax season is over and you have a clear picture of your assets and liabilities, or when life’s big events occur. A birth of a child, the passing of a close relative, a divorce or an estrangement with a loved one.

Every estate planning attorney has stories of reviewing estate plans with clients and finding that they have left money to a person they no longer speak with or an ex-spouse is still their beneficiary. Another common error is giving someone an asset that the person no longer owns, like a share in a business or a piece of property.

The word “estate” does make it sound like something for people who live in mansions, but this kind of plan is for everyone. If you don’t have one, now is the time to get started.

Reference: Forbes (April 15, 2019) “Why Estate Planners Aren’t Just For The Ultra-Rich”