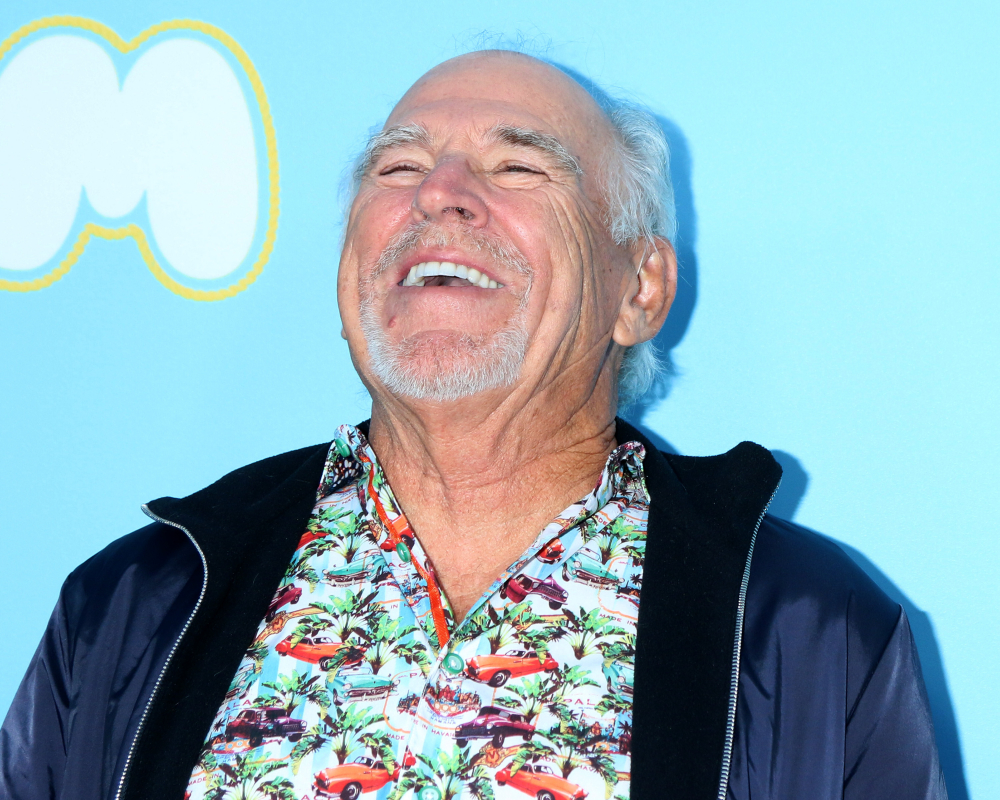

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

FLORIDA’S NEW ELECTRONIC WILLS ACT

Florida passed the Electronic Documents Act (HB 409), which was signed into law by Gov. DeSantis on June 7, 2019. The law will take effect on January 1, 2020.

Wasn’t this vetoed in 2017?

In 2017, the Florida legislature passed a bill that would have permitted electronic signatures on wills. It was vetoed by Gov. Rick Scott in 2017, and he expressed the importance of finding “the right balance between providing safeguards to protect the will-making process from exploitation and fraud while also incorporating technological options that make wills financially accessible.”

Earlier this year, the Florida legislature passed a revised bill that was signed into law by Gov. Ron DeSantis this summer. The Department of State is responsible for establishing rules to ensure that a will in electronic form cannot be tampered with or altered.

Who cares?

Before this law change, Florida’s approach to wills was to require “strict compliance” with all execution formalities. The requirements for the valid execution of a Florida will are set out by Fla. Stat. § 732.502.

The requirements are as follows:

- The will must be in writing.

- The testator must have testamentary capacity (this is not specifically set out in Fla. Stat. § 732.502, but it is a requirement for all estate planning documents).

- The will must be signed by the testator or by a person at the testator’s direction in the presence of two witnesses.

- The two witnesses must sign the will in the presence of the testator and in the presence of each other (the testator and both witnesses must be in the same room when everyone signs and they all must sign while all three people are present).

This law change allowing electronic signing, witnessing and notarization of wills and other estate planning documents is a huge transformation from the current law.

Are there any safeguards?

- The notary must ask certain questions of the signor relating to impairment or disability if the witnesses are not in the physical presence of the signor. If they are not properly answered, then remote witnessing is ineffective.

- Are you under the influence of any drug or alcohol today that impairs your ability to make decisions?

- Do you have any physical or mental condition or long-term disability that impairs your ability to perform the normal activities of daily living?

- Do you require assistance with daily care?

- If the principal signor is a “vulnerable adult” as defined in Fla. Stat. § 415.102, the witnesses must be in the presence of the principal signor. If they are not, the witnessing is invalid.

- [“Vulnerable adult” means a person 18 years of age or older whose ability to perform the normal activities of daily living or to provide for his or her own care or protection is impaired due to a mental, emotional, sensory, long-term physical, or developmental disability or dysfunction, or brain damage, or the infirmities of aging.] Stat. § 415.102.

- If witnesses are not in the physical presence of the signor, then additional questions are asked of the signor for the video/audio record are undertaken by the notary.

- Are you currently married? If so, name your spouse.

- Please state the names of anyone who assisted you in accessing this video conference today.

- Please state the names of anyone who assisted you in preparing the documents you are signing today.

- Where are you currently located?

- Who is in the room with you?

- An electronic will or codicil is revoked by deleting or obliterating an electronic record, with the intent to revoke, as provided by clear and convincing evidence.

- Remote witnessing requires that the witness hear the signer acknowledging the signer’s signature.

- Self-proof affidavits for wills can be electronically witnessed and notarized, if the electronic record that contains the will is held by a qualified custodian at all times before being offered to probate.

- The electronic will can be admitted to probate if filed through the e-filing portal, and is deemed to be an original of the electronic will. A paper copy of an electronic will which is certified by a notary public to be a true and correct copy can also be admitted to probate as an original will.

Will electronic wills become the norm?

Probably not, at least not for a while. The law requires that electronic wills be stored by a “qualified custodian.”

A qualified custodian of an electronic will must meet the following requirements:

- Must be domiciled in and a resident of Florida or incorporated or organized in Florida;

- Must consistently employ a system for maintaining custody of electronic records and store electronic records containing electronic wills under the system; and

- Must furnish for any court hearing involving an electronic will that is currently or was previously stored by the qualified custodian any information requested by the court pertaining to the qualified custodian’s policies and procedures.

A qualified custodian must maintain an audio-video recording of an electronic will online notarization. A qualified custodian is liable for the negligent loss or destruction of an electronic record and may not limit liability for doing so. The law also prohibits a qualified custodian from suspending or terminating a testator’s access to electronic records. The law requires a qualified custodian to keep a testator’s information confidential.

Is this a good thing? What should I do next?

The goal of the new law is to increase access to legal services at a time when most Floridians don’t have a will or bother with estate planning. However, there are still many questions and concerns about this new law. Florida is only the fourth state to implement laws related to the execution and storage requirements for electronic wills. One concern is whether other states will honor a properly executed Florida electronic will. Estate administration can already be a complex process – there is no need to add uncertainty and potential probate litigation into the mix.

Until all the kinks are worked out, we are not recommending that our clients to become the guinea pigs for these new laws, as there may be unforeseen consequences that would negatively impact your estate planning goals.