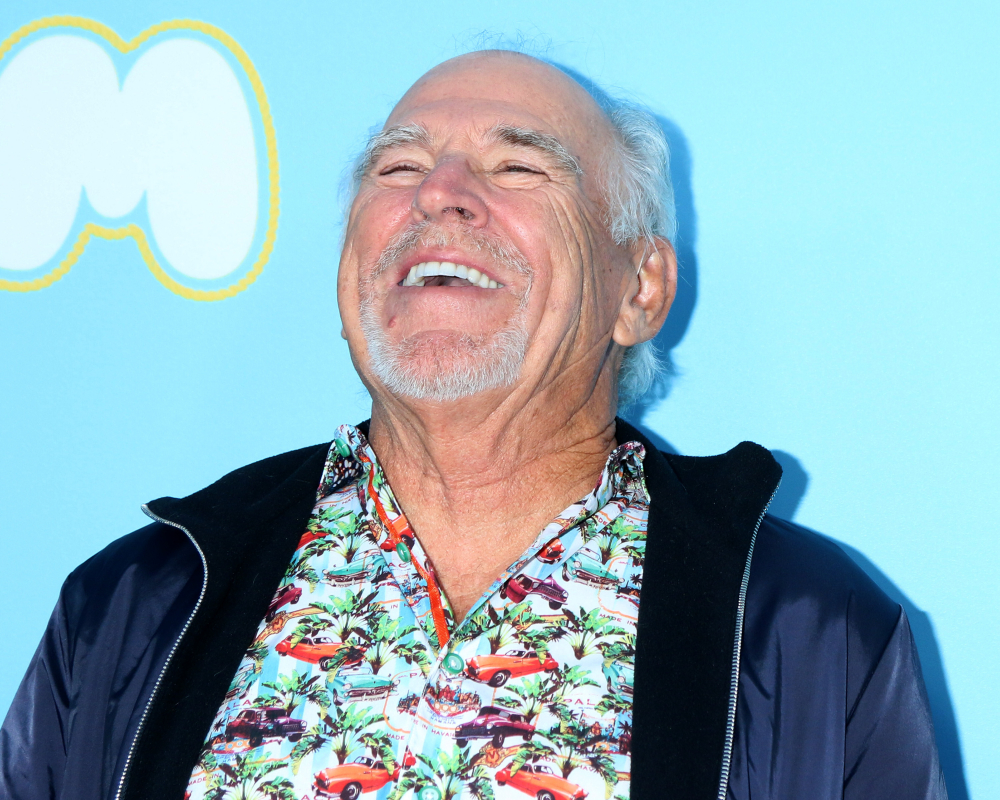

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Top Five Estate Plan Epic Fails

The problem with mistakes to an estate plan, is that many are irreversible and cannot be fixed. Those that can be fixed are often expensive. It is best to do it right the first time.

Many of the top reasons for estate plans to fail, are a matter of maintenance. Just as your home or car needs ongoing care, so does your estate plan. The simple things often lead to the biggest problems.

Investopedia’s article, “5 Ways to Mess Up Estate Planning” gives us a list of these common issues.

Not Updating Beneficiary Designations. Be certain those to whom you intend to leave your assets are clearly named on the proper forms. Whenever there’s a life change, update your financial, retirement, and insurance accounts and policies, as well as your estate planning documents.

Forgetting Key Legal Documents. Revocable living trusts are the primary vehicle used to keep some assets from probate. However, having only trusts without a will can be a mistake—the will is the document where you designate the guardian of your minor children, if something should happen to you and/or your spouse.

Bad Record keeping. Leaving a mess is a headache. Your family won’t like having to spend time and effort finding, organizing and locating your assets. Draft a letter of instruction that tells your executor where everything is located, the names and contact information of your banker, broker, insurance agent, financial planner, attorney, etc. Make a list of the financial websites you use with their login information, so your accounts can be accessed.

Faulty Communication. Telling your heirs about your plans can be made easier with a simple letter of explanation that states your intentions, or even tells them why you changed your mind about something. This could help give them some closure or peace of mind, even though it has no legal authority.

Not Creating a Plan. This last one is one of the most common. There are plenty of stories of extremely wealthy people who lose most, if not all, of their estate to court fees and legal costs, because they didn’t have an estate plan.

The solution is simple: make a recurring appointment with your estate planning attorney every two or three years, or when something big in your life changes. Follow through on the instructions, like funding a trust or talking with heirs about your thought processes for asset distribution.

Reference: Investopedia (September 30, 2018) “5 Ways to Mess Up Estate Planning”