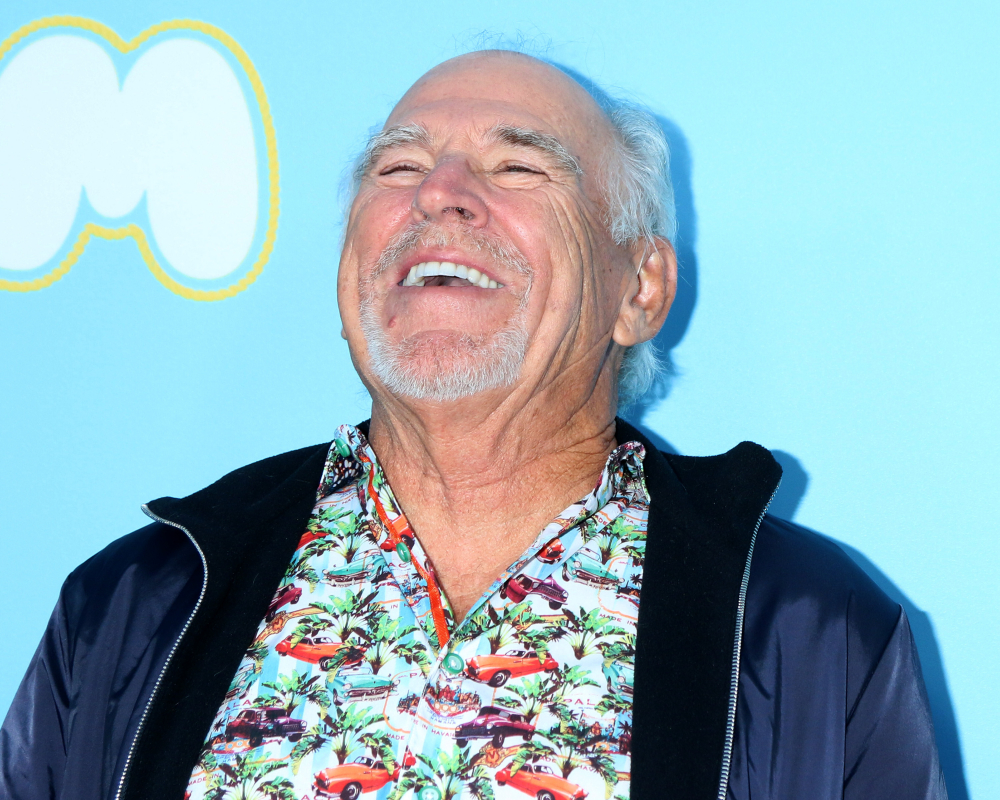

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Common Concerns in Estate Planning

There are certain questions that every estate planning attorney knows will be asked the first time they sit down with clients. Understanding them makes the process easier.

Probate is one of a handful of questions that are routinely asked by clients new to the estate planning process. Figuring out who to name as an executor for your estate and naming guardians for minor children are also concerns. Finally, a bigger conversation about whether or not you can use a form from the internet to create a will is taking place, both in estate planning attorney offices and at kitchen tables.

Next Avenue’s recent article, “Probate, Wills, Executors: Your Estate Planning Questions Answered,” addresses each of these questions.

Probate. Probate is the legal process for transferring your assets to your heirs. It’s governed by the law in the state where you were a resident at the time of death. Each state has its own cutoffs for the size of an estate that can be transferred without going through probate. In some states, the limit is a few thousand dollars, but in some it’s $200,000. In addition, probate is a public notice of death. This allows creditors to file claims against an estate. After they are paid, the rest of the estate goes to the beneficiaries. You may want to avoid the lengthy process, the expenses and fees and perhaps even the publicity. It is important to remember that probate proceedings are open to the public.

The need for an attorney. You should hire an experienced estate planning attorney to draft your will. Many Americans in their 50s and 60s don’t have one and it becomes a real problem for their heirs! A recent Caring.com survey found that 40% of boomers don’t have a will. The more complicated your instructions for passing your assets, the more important it is to use a lawyer. Complexities, nuances, and intricate state probate and tax laws, often result in expensive errors in self-drafted documents. Your tax software may have guaranteed the results, but your heirs will be on their own if your do-it-yourself will is flawed or, something that happens very often, not recognized by the court as legal. Finally, make certain that your heirs know where your will is kept and keep it up-to-date.

Naming an executor and a guardian for minor children. Determining who should be your executor is an important decision. This is the person who will have a legal responsibility to make sure that your wishes, as stated in the will, are followed, and that includes taking responsibility for transferring assets, paying debts and making sure all the details are followed. You will need to choose someone you trust who also has the capacity to either carry out these tasks or to know when they need help. Naming a guardian for minor children is equally challenging, since the person has to be someone who will be entrusted with raising your children as you would want them to be raised.

However, if you do not name either an executor or a guardian in your will, or if you do not have a will, the court will name someone. That person may be a complete stranger, or it may be someone you don’t trust or respect. It’s best to do this as part of your estate planning.

Reference: Next Avenue (April 7, 2017) “Probate, Wills, Executors: Your Estate Planning Questions Answered”