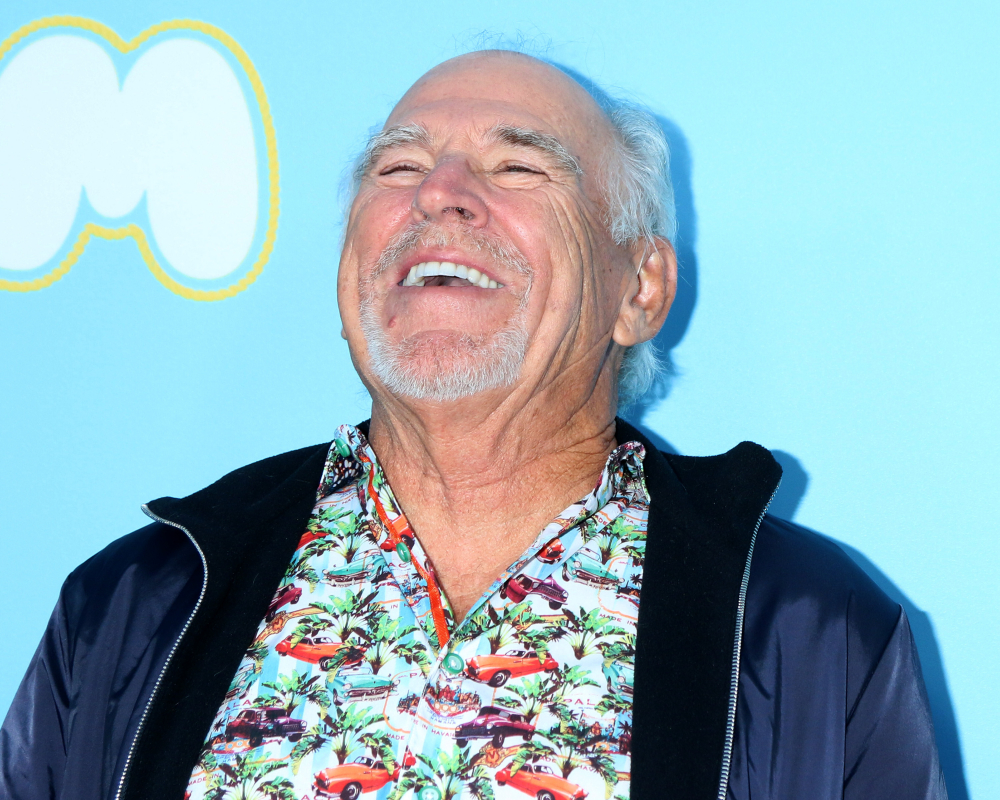

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Asking the Wrong Question About When to Retire

Deciding when you should retire should be guided by a number of factors, including when you can afford to retire and if you have a plan of what to do with the rest of your life.

In an ideal world, retirement income should be the driving force behind your decision when to retire, according to a recent article in Kiplinger, “Income, Not Age, Should Determine Your Retirement Date.” If you don’t have the income that will support the retirement lifestyle you want, you aren’t ready. That income is what will give you the independence that retirement is all about.

Get focused. Don’t think about just stopping work at 60, 65, or even 70, without a retirement income plan to pay your bills. People spend years focused on growing and saving their money, but fail to change their mindset as to how they’ll manage that money when they no longer have a paycheck. Instead, they choose an age—62, 65, 66, 70—one of several milestone years for Social Security and Medicare. Those are the ages when most people retire.

Go beyond savings. With the assistance of a wealth manager, begin examining your current fixed-income sources: Social Security, a defined-benefit pension (if applicable), or an annuity and how you can help maximize those with the proper timing and claiming strategies.

Make a budget. Create an approximate but realistic retirement budget. Major expense categories are mortgage and car payments (if applicable), food, transportation, and health care. You should also add in travel, gifts and hobbies. You might also need some services as you age, like yard work or nursing care.

After you calculate your fixed income and your budget needs, you can see if there’s a gap. If you have more than enough money to cover your expenses, you may be able to retire earlier than you thought. However, if not, you’ll have to figure out how you’ll draw funds from your retirement fund to close that gap.

Stay open to changing circumstances. Change and unexpected twists are all part of life. You may have had a great plan, then something happens—it usually does, especially when retirement may last several decades. Start with well-designed plan, and be open to change, like a part time job or a relocation, and you increase the likelihood of a secure retirement.

Reference: Kiplinger (October 2017) “Income, Not Age, Should Determine Your Retirement Date”