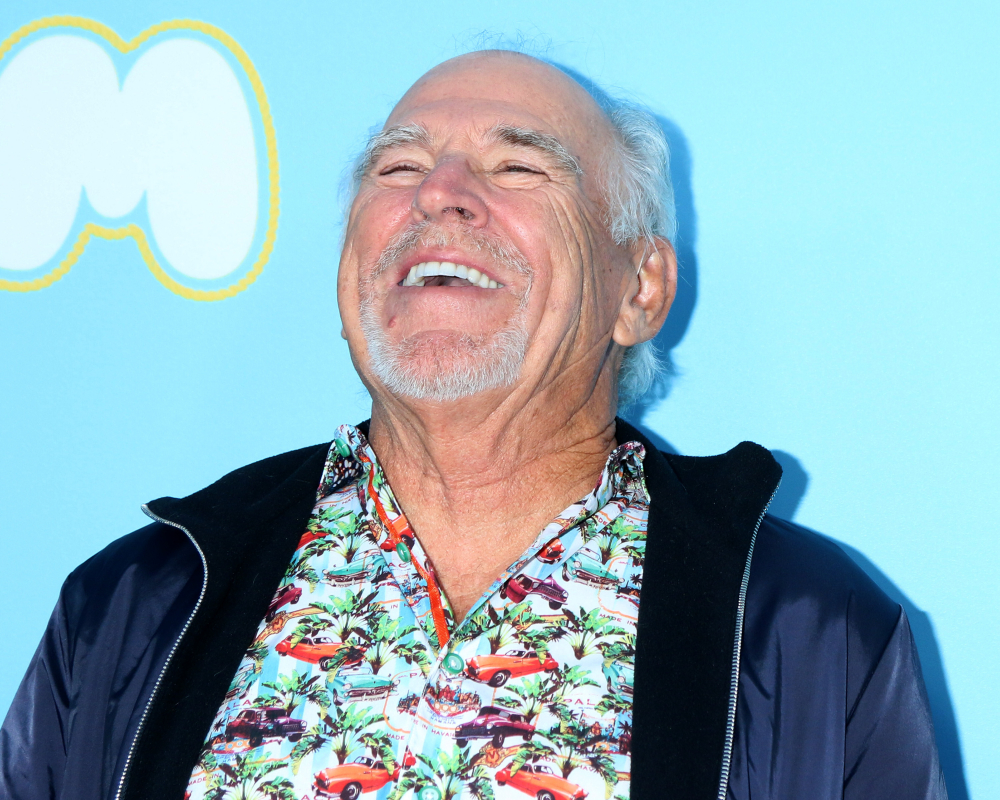

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

What Does an Executor Do?

If you’ve been asked to serve as an executor of an estate, it will be important for you to understand your responsibilities. It is both an honor to be asked to carry out your family member or friend’s final wishes, but it is also a lot of work.

A useful article appearing on WMUR, “Settling an estate,” explains that an executor is the person designed in an individuals’ will to distribute their property, pay any debts or expenses and make sure that the estate’s tax returns are filed.

When an executor isn’t willing or able to perform his or her duties, there’s usually an alternative. If no alternative has been named, the courts will approve an executor for the estate.

Being the executor of an estate can be a difficult and time-consuming task. In some instances, the deceased may have left a letter of instruction that will make the process easier. The letter may contain information such as a list of documents and their locations, contact info for attorneys, accountants, financial planners, a list of creditors, login information for important web sites and final burial wishes.

The will is usually located with these documents. The executor will need to obtain a copy, and read and understand the contents. A review of the will with an estate planning attorney is done in order to decide which type of probate is necessary. An inventory of assets owned by the deceased is then taken by the executor and may be required by the probate court. Some of the assets may need to be appraised. After probate is finished, the assets may be sold or gifted, according to the deceased’s wishes.

Asset protection is a major concern at this time. It may include changing locks on property. The executor will likely need to pay mortgages, utility bills and maintenance costs on property. He or she will need to change the name on the home and auto insurance policies, and brokerage accounts will need to be retitled.

Final expenses also need to be paid. The funeral home or coroner will provide death certificates that will be needed for various tasks in the future, such as filing life insurance claims. If the deceased was collecting Social Security for example, the agency will need to know of the death, so benefit checks can be stopped. Checks received after the death will need to be returned. A final federal and state tax return for the deceased may also need to be filed, along with an estate and gift tax return.

The executor is responsible for the management and distribution of assets (known as the “fiduciary duty”), while dealing with the emotions of a grieving family. To ensure that the executor’s tasks are completed properly, it may be helpful to enlisting the advice and guidance of an experienced estate planning attorney.

Reference: WMUR (May 24, 2018) “Settling an estate”