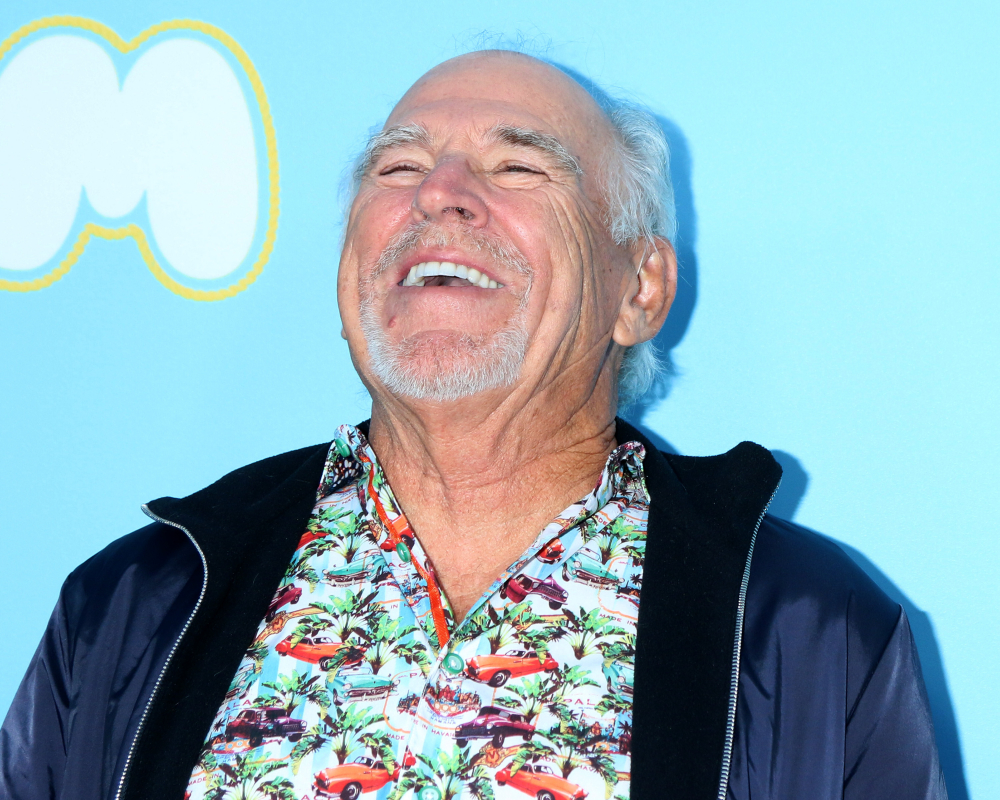

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

My Spouse Passed Away. What Happens to the Medical Bills?

It is possible that a spouse may be responsible for the outstanding medical bills, depending upon what papers were signed when the person entered the hospital or other care facility.

Generally, there are some items that a spouse might be required to pay, and others for which the spouse isn’t responsible.

nj.com’s recent article asks, “Do I have to pay my dead spouse’s medical bills?” As you might imagine, it all depends on the specifics of the circumstances.

Spouses typically aren’t responsible for each other’s debts, unless they sign paperwork agreeing to pay, like a guarantor.

For medical bills, use caution with all of the forms required to be signed upon admission to a hospital. This can be an issue in the case of an emergency, when a spouse will hastily sign the paperwork admitting the ill spouse. Nonetheless, care should be taken to read these papers prior to signing.

The estate of the deceased spouse is generally responsible. The estate will usually pay reasonable medical and hospital expenses related to the deceased’s last illness.

If there are assets that pass to the surviving spouse, the executor is responsible to pay those medical bills from those assets. The executor must coordinate the assets of the estate and pay the deceased person’s debts, including credit card debt, before assets are distributed to the beneficiaries.

Among the executor’s duties are going through and assessing all of the late spouse’s assets. The executor is responsible for managing the assets, until they are properly distributed to those in the will and to creditors.

Work with a trusted estate planning attorney to make sure that the estate or the surviving spouse do not pay any bills that are not required to be paid.

Reference: nj.com (October 23, 2018) “Do I have to pay my dead spouse’s medical bills?”