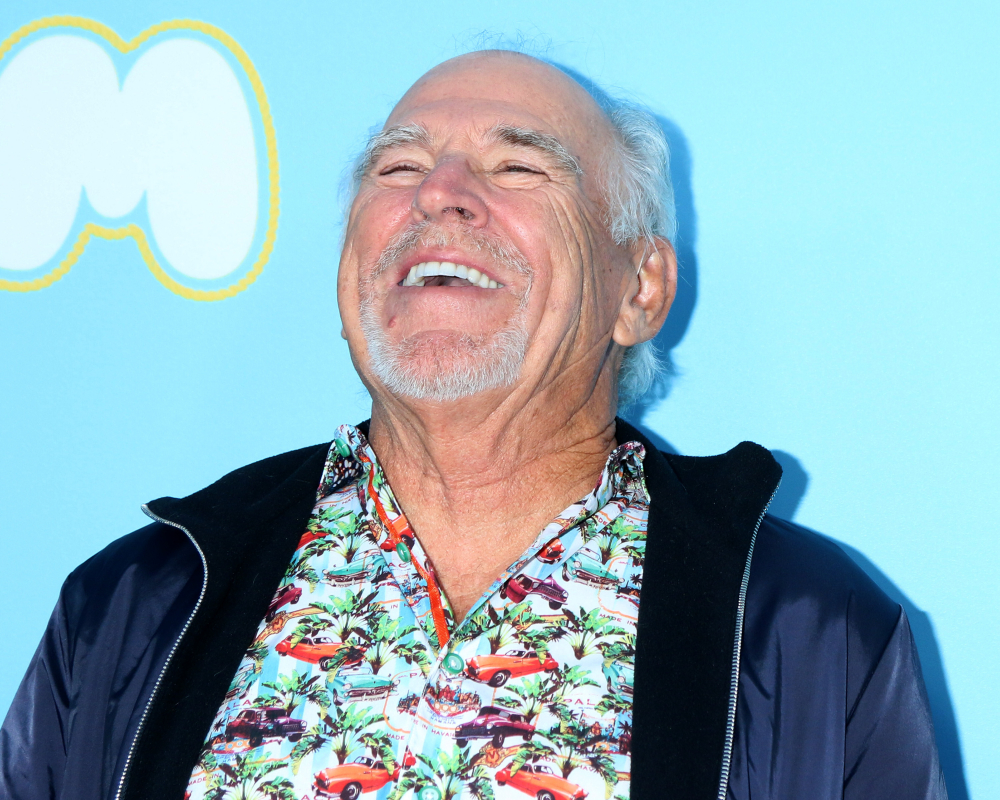

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Legacy Planning for the Future

Today’s complex and uncertain world makes the management and preservation of tangible assets more challenging than in the past.

In the next few decades, the largest wealth transfer between generations in recent history will take place. This makes legacy planning more important than ever. It also presents an opportunity: the chance for one generation to thoughtfully share its ideas of what wealth means to a family, what the family values are and determine the best way to pass both wealth and values along to the next generation.

Forbes’ recent article, “3 Principles For A Successful Family Legacy,” says that frequently the failure to maintain wealth through the generations is because of a lack of communication, education and trust among generations, not a poor investment strategy or a series of economic downturns. Families who are successful at transitioning wealth from generation to generation, stick to three core legacy planning principles.

Integrating planning. Legacy planning is a collaborative effort that requires open discussion with your wealth advisor, family members and your estate planning attorney. You should first define your goals—how you want to enjoy your wealth and how you want it to benefit your family members and your community. Your legacy is about providing financially for future generations, along with how you want to be remembered. Discussing your values and ambitions to your advisors and those important to you, can help you develop a detailed wealth plan that is consistent with your legacy goals.

The creation of a healthy family wealth culture. Create a healthy culture with a shared set of attitudes, values, goals and behaviors that characterize you as a family. This is vital for legacy planning. Those families who develop a healthy attitude regarding their wealth through open and honest dialogue, are typically more likely to see their wealth preserved from generation to generation.

Develop the next generation. When developing your legacy, be sure to help younger generations understand that thoughtful spending, investing and charitable giving can add to a sense of purpose.

To help move wealth and values across generations, consider a family meeting with your estate planning attorney. If your children are more involved with your wealth management and estate plan, they will be more able to protect your legacy. Age-appropriate transparency, as they are growing up, will make everyone more comfortable with the legacy process.

Reference: Forbes (July 13, 2018) “3 Principles For A Successful Family Legacy”