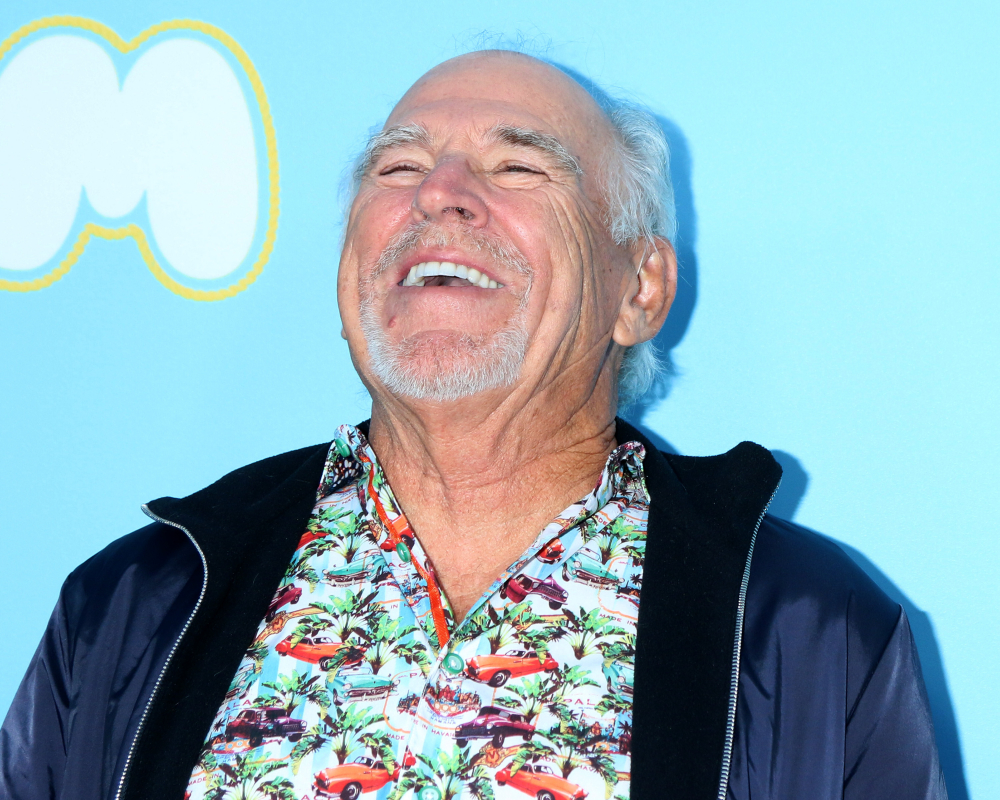

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

How Do We Create a Realistic Budget for Retirement?

If you fall prey to the rose-colored glasses approach to retirement, you may be in for unpleasant surprises when retirement finance gets real. Be prepared and avoid these fictions.

During our working years, it feels like we’ll never actually get to retirement, or spending the money that we have worked for and saved for so long. However, when the time finally comes, you’ll enjoy those dollars far longer, if you don’t lose them because you didn’t square facts with fiction.

US News & World Report’s recent article, “7 Myths About Finances in Retirement,” says that moving into this new phase of life, can create changes in your finances and lifestyle. For most of us, despite the planning, there’ll still be some surprises when you enter retirement. Here are some of the most common financial myths about retirement, as well as the realities behind them.

1. Medicare covers everything. You’ll be eligible for Medicare the month you turn 65. However, you should remember that there’ll still be ongoing health care expenses. Medicare only covers some services for free. Unless you qualify for Medicaid, you’ll need to budget for costs like premiums, copays, and deductibles. You’ll also need a Medicare supplement plan, which can be affordable but is not free. Note that Medicare only provides some coverage for long-term care. Consider buying long-term care insurance to help pay for additional services.

2. I’ll just need 70-80% of my pre-retirement income. You may discover that you want to spend money on travel, dining, or a new hobby. Because people are healthier and more active today than in past generations, they actually require more money to go out and do what they’d like in their retirement.

3. Taxes are nothing in retirement. Since you’re no longer bringing home a paycheck from working each month, you may assume that your taxes will decrease in retirement. Maybe, but you’ll likely need to plan on paying taxes each year.

4. Downsizing means more savings. A common retirement transition plan includes moving out of the family home and into a smaller place. You might think this means fewer home-related costs, but that’s not always true.

5. $1 million is all I need for a comfortable retirement. For years, building a $1 million nest egg was thought of as a goal for retirement. However, that figure may no longer be accurate, due to longer life expectancies, increasing costs, and active lifestyles. There’s no specific one-size-fits-all amount to save for retirement.

6. I can withdraw 4% each year from my portfolio. This rule refers to the concept of withdrawing 4% from a retirement account each year. The idea is that you’ll be able to maintain a steady stream of income, while keeping the funds sustainable for many years. But again, with increased life expectancy and recent challenges, many retirees are severely underfunded for retirement. Consider withdrawing a lower percentage, such as 3% each year.

7. We’ll both be able to age in place. No one expects to have to move their loved one, or to be moved, to a nursing home or an assisted living facility. However, it happens to most seniors at some point during their later years. Even if you are among the lucky who can stay home, home care for an extended period is expensive too. Factor in the cost of long-term care insurance, if you are able to purchase a policy. Speak with an elder law attorney to have a plan in place, before an emergency situation occurs, so that you can protect your assets and make sure that you or a loved one gets the care needed.

Reference: US News & World Report (April 18, 2018) “7 Myths About Finances in Retirement”