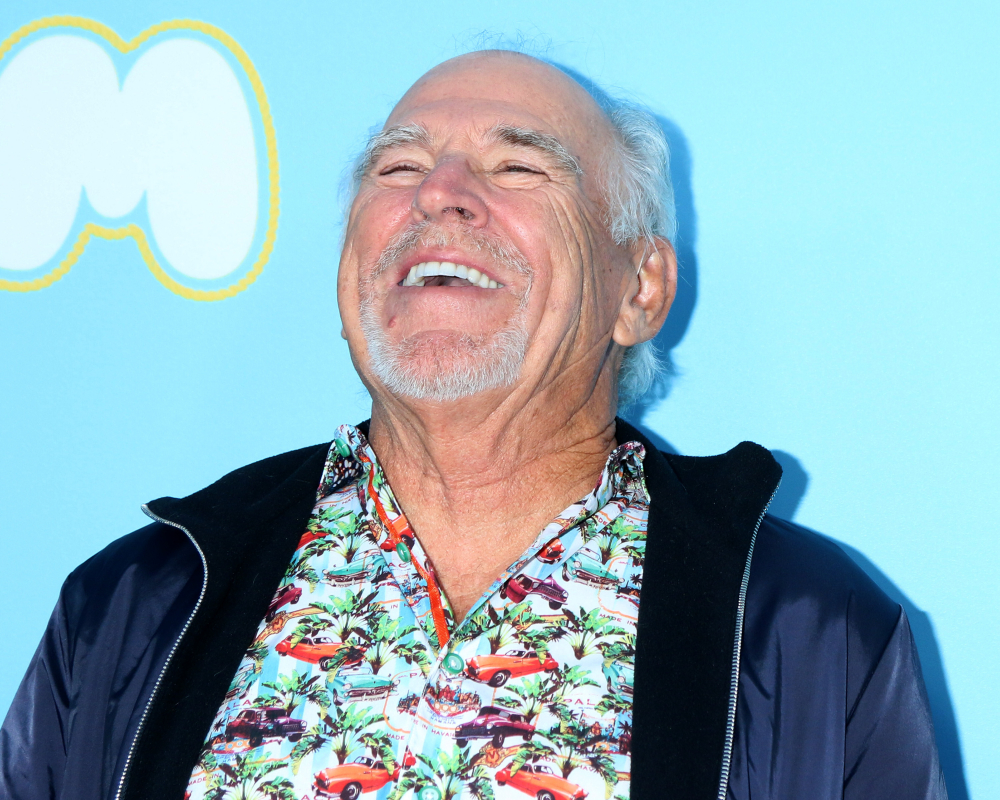

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

Advance Planning for Diminished Capacity

The good news is that we are living longer. However, many of us will experience a time at some point in our lives, when we are not able to take care of ourselves. We think of this more as a problem of the elderly, but there are young and healthy people who also become suddenly incapacitated. The best protection for you and your family is to have a plan in place, long before anything occurs.

Forbes’s recent article, “Protect Yourself Against Diminished Capacity,” reminds us that incapacity can be either mental or physical, and it can be for a short time or permanent.

Based on your financial situation, health, and age, long term health care and/or disability insurance might be a wise strategy. That’s because you can insure against loss of income and the direct costs of assisted living arrangements. In addition, there are some legal documents that can prevent many problems for your family, care givers and yourself. Let’s review some of these:

If you have properties, business interests, and investment accounts, holding them in revocable living trust gives you several benefits. Most people want to be the sole trustee (decision maker), as long as they’re able to do so. Until and unless you’re unable to act for yourself, you control the assets and retain all powers to act. In the event you’re not able to act for yourself, a trust will designate a contingent trustee to act on your behalf, until you can resume the management of your affairs.

You can decide the circumstances in which they would take control and the powers they’d have to act on your behalf. Your trust might create the basis of your estate plan to avoid probate, minimize estate taxes, distribute your property as you want and protect your family from financial predators.

A financial power of attorney can help with decisions about your checking accounts, savings accounts, your home or personal property. You appoint a person to act on your behalf to pay your bills, etc.

Healthcare directives and medical powers aren’t only for end-of-life situations. They can be used if you suffer an accident or illness that leaves you unable to give or withhold informed consent.

Every state has its own requirements for these and other legal documents, so you’ll want to work with an experienced estate planning attorney in your state to create a plan. She or he will be able create a personalized approach that works best for your situation.

The goal is to have these documents in place, before anything unexpected occurs.

Reference: Forbes (August 9, 2018) “Protect Yourself Against Diminished Capacity”