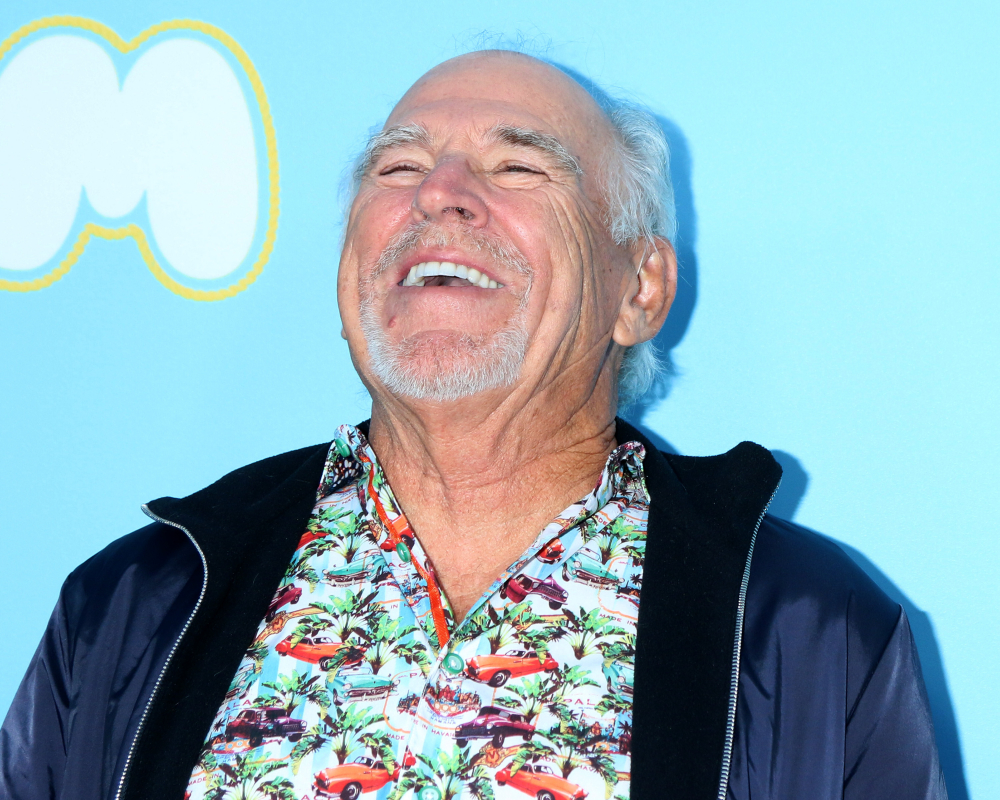

When Jimmy Buffett died in September 2023, he left behind more than a legendary catalog…

In Your 30s? Get Fiscally Fit Now, and Your Future Self Will Thank You

It seems impossibly far away when you are in your thirties. Why should you start putting away money for retirement now, when you’re young and there’s still so many other things you’d rather be doing with your money? It is because time has a way of creeping up on us.

Once you decide when you want to retire, you need to calculate how much money you’ll need and how you’ll get there. Of course, you should take advantage of company matching and various tax deductions, when saving for retirement and don’t wait until your 40s, or 50s, to try to catch up. That will be painful, or worse, impossible.

Forbes’s recent article, “3 Steps To Financial Fitness In Your Thirties,” advises that when you start to accumulate wealth, be sure someone is watching your investments and that those investments are suitable for your time frames and financial goals. Here are some tips for how you can make saving for retirement a reality.

Work with a fiduciary advisor you think can help improve your situation. This should be someone you trust, and most important of all, who you feel has your best interests at heart.

If you are accumulating assets, make sure they’re protected. And be certain you and your family are covered by having the correct insurance policies. Of course, in a perfect world nothing would happen. For instance, most people on disability would much rather be healthy. They’d love to be able to joke and say that having that disability insurance was a “bad investment”. However, those who are disabled and aren’t covered with a disability insurance policy most likely wish they’d made sure they had this income protection in place.

Another form of protection is an emergency fund. If you don’t have one, start by regularly putting some amount of money into a non-retirement account. Even if it’s a small amount, something is better than nothing. If you were to be laid off, chances are that your unemployment benefits would not be enough to pay the rent or make a mortgage payment.

If you’re single, you should protect yourself—even more so than someone who has a partner to rely on. Many life insurance policies have living benefits that can protect you if an emergency happens. You may also be able to use cash value life insurance to partially fund your retirement.

Finally, it’s critical that you think about estate planning.

If you think you’re too young to need an estate plan, you’re wrong. Your estate plan should include a will, Powers of Attorney, health care power of attorney and, if you have minor children, a guardian should be named in your will. If you’re married, your spouse will be better protected, if something unexpected should happen. And if you’re living with someone, no matter how long you’ve been together, they won’t have any legal right to inherit any of your property or assets, unless you specifically include them and the assets you want them to have in your will.

Reference: Forbes (December 17, 2018) “3 Steps To Financial Fitness In Your Thirties”